Technology integrations and low-code tools have emerged as powerful solutions, streamlining processes, enhancing customer experiences, and boosting operational efficiency. In this article, we explore the empirical impact of technology integrations, backed by metrics and real-world examples. Discover how insurers are leveraging these integrations to stay ahead in the rapidly evolving digital landscape.

The insurance sector has recently undergone a major revolution driven by technological advancements. Technology integrations and low-code tools have emerged among these innovations as robust solutions to streamline processes, enhance customer experiences, and boost operational efficiency. A recent report by Information Services Group (ISG) highlights the emerging low/no-code development platform market is currently valued at nearly $15 billion USD.

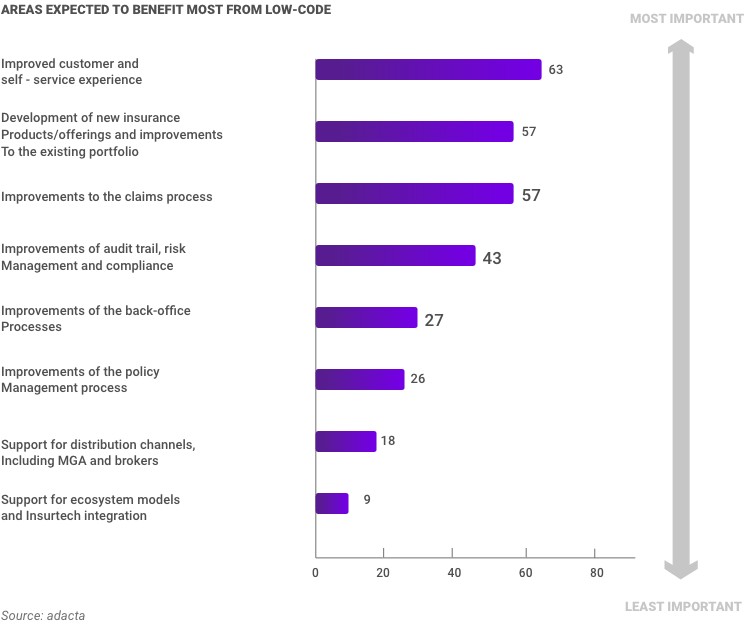

This market is expected to expand fourfold over the next five years. Implementing low/no-code platforms can lead to substantial cost savings of up to 70%, and they can be set up in as little as three days. In contrast, the lengthy process of modernizing legacy systems can take up to two years. An Adacta study found almost 82% of insurance companies operate faster due to low-code technologies and practices.

Source: Adacta

1. Enhancing Customer Experience

Technology integrations seamlessly combine different systems and platforms enabling insurers to streamline processes, improve operational efficiency, and deliver exceptional customer experiences. Low-code tools are innovative platforms that streamline application development processes. They enable insurers to rapidly create customized applications with minimal coding, boosting operational efficiency and enhancing customer experiences. A survey by McKinsey indicates almost 90% of insurance executives consider improving customer experience a top priority.

Source: McKinsey

FUTURE-PROOF YOUR LIFE WITH INSURANCE TRENDS FOR 2024

Explore how the insurance industry is evolving to meet the changing needs of businesses. Dive into the key trends shaping 2024 and beyond!

Let us examine some key benefits:

Streamlining Claims Processing

Insurance companies can expedite claims processing by integrating their systems with advanced analytics and artificial intelligence (AI). Consequently, there is a significant reduction in claim settlement times, leading to higher rates of customer satisfaction. Lemonade, for example, is an insurtech company that leverages technology integrations to expedite claims processing. By integrating advanced analytics and AI algorithms into their systems, they can process claims in a matter of seconds, ensuring a seamless customer experience.

Source: Lemonade

Personalized Offerings

Low-code tools and platforms empower insurers to develop and deploy customized insurance products swiftly. By leveraging customer data and predictive analytics, insurers gain insights into customer preferences, allowing them to tailor policies accordingly. This approach facilitates personalized coverage options such as usage-based insurance, which rewards safe driving habits with lower premiums. The success of companies like Metromile and Root Insurance in offering personalized policies demonstrates the effectiveness of low-code tools.

Sources: Metromile & Joinroot

2. Improving Operational Efficiency

Efficiency in operations plays a critical role in insurers’ profitability, making technology integrations and low-code tools invaluable for streamlining processes and enhancing operational efficiency. Some relevant metrics include:

Reduction in Manual Work

Implementing low-code tools enables insurers to achieve up to a 40% reduction in manual effort, as revealed by a study conducted by Accenture. Automation of repetitive tasks like data entry and document processing frees up valuable time for insurers to focus on activities of higher value, resulting in increased productivity.

Source: Accenture

Accelerating Underwriting

Technology integrations and low-code tools empower insurers to automate and expedite the underwriting process. By integrating external data sources and leveraging AI algorithms, insurers can obtain real-time risk assessments, reducing underwriting time from weeks to minutes. Ping An, leading Chinese insurer, for example, achieved a remarkable 79% reduction in underwriting time by harnessing technology integrations and advanced analytics.

Source: Pingan

3. Enabling Seamless Collaboration and Integration

Insurance companies often rely on multiple systems and platforms to manage various operations. Technology integrations and low-code tools facilitate seamless collaboration and integration across different departments, eliminating data silos and improving communication. Here’s how insurers benefit:

Improved Data Accessibility

Through technology integrations, insurers can consolidate data from disparate sources into a centralized system. This consolidation ensures easy access to accurate and up-to-date information, enhancing decision-making processes. Salesforce’s integration capabilities, for example, enable insurance companies to unify customer data, providing a comprehensive view of customer interactions.

Source: Salesforce

Agile Development and Deployment

Low-code tools enable insurers to rapidly develop and deploy applications without extensive coding knowledge. This agility empowers insurers to respond quickly to market demands, staying ahead of the competition. For instance, multinational insurer AXA utilized low-code tools to build an innovative mobile app for managing insurance policies, resulting in improved customer engagement and retention.

Source: Axa

Gartner’s projections for 2025 indicate expenditures on low-code development technologies are anticipated to reach almost $30 billion USD. This represents a compound annual growth rate (CAGR) of 20.9% from 2020 through 2025, highlighting the rapid expansion and adoption of these technologies.

Source: Adacta

Conclusion

Empirical evidence shows technology integrations and low-code tools have revolutionized the insurance industry, enabling insurers to rapidly develop applications, drive growth, and deliver exceptional customer experiences. By leveraging these technologies, insurers streamline processes, enhance operational efficiency, and provide personalized solutions.

These innovations have accelerated application development, increased developer productivity, and improved customer satisfaction. As the industry continues to evolve, these tools remain crucial in shaping the future of insurance in a rapidly changing digital landscape.