Risk Reinvented: AI & Agents in the Insurance Industry — inside the panel where legacy meets AI-led scale.

Most people don’t associate insurance with speed.

But that’s changing.

Behind the scenes, insurers are rewriting the rulebook. Not just to handle claims faster or price premiums smarter, but to fundamentally reshape how risk is assessed, transferred, and managed. And the engine behind this shift? AI agents that are no longer working in isolation, but embedded deep within underwriting, fraud, and policy ops.

By mid-2025, more than 90% of global insurers are in some stage of AI deployment. And a growing number, 40% by Q4, will be using AI agents as operational teammates. That’s collaboration, not just automation.

What’s Behind the Momentum?

- Risk is getting weirder: Cyber volatility, climate shocks, geopolitical flux: today’s risks don’t follow last decade’s models. AI brings speed, context, and pattern recognition at a scale that human-led teams can’t match alone.

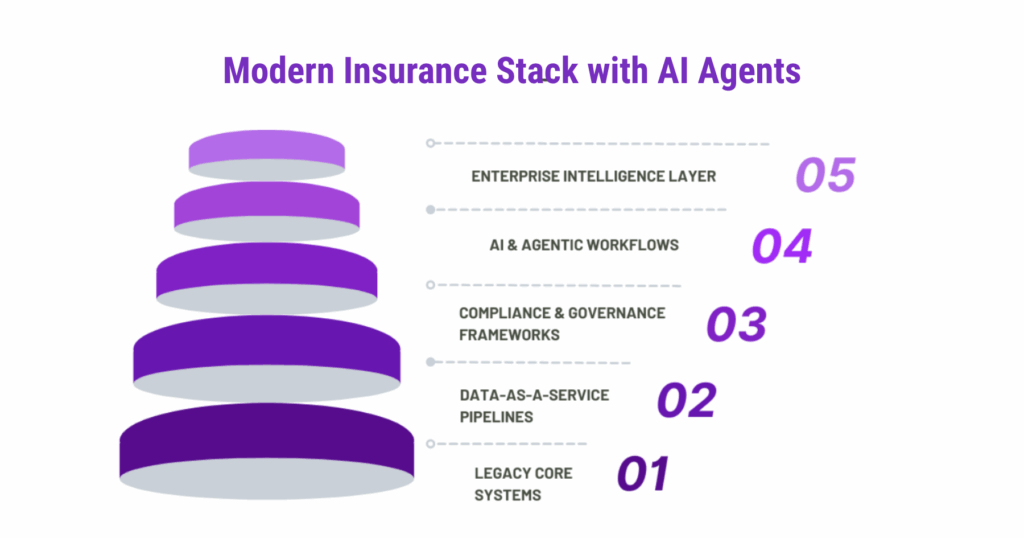

- Legacy tech is cracking: Insurers are racing to modernize systems built for static risk in a dynamic world. That’s leading to smarter data pipelines, “data-as-a-service” models, and platform-wide refactoring.

- AI is maturing inside the enterprise: This isn’t chatbot territory. We’re talking predictive claims adjusters, generative underwriting companions, and compliance-aware automation frameworks, operating with real stakes, real oversight, and real business impact.

- Trust is the new frontier: As systems get smarter, so do regulators, boards, and customers. Explainability, auditability, and transparency aren’t just checkboxes, they’re differentiators.

With risk models evolving and AI agents moving from pilots to production, we’ve curated a panel of insurance leaders who’ve seen the shift up close. Explore how legacy players are embracing AI in ways that are practical, scalable, and regulation-ready. Learn more below and register for TechXchange 2025:

Join us at TechXchange 2025 • Sept 4 in NYC • Register now →

Across the insurance landscape, AI is being used to streamline specialty programs, re-architect digital infrastructure, turn data into a predictive edge, and embed intelligence into workflows that reduce manual overhead and sharpen underwriting precision. These are signals of an industry retooling itself from the inside out.

At TechXchange 2025, this shift takes center stage.

The insurance panel brings together leaders from Allied World, Crum & Forster, Tokio Marine North America Services, and Amynta to unpack what real AI deployment looks like in legacy-rich, regulation-heavy environments. This, along with live demos, field insights, and honest debates about what’s working and what still needs fixing.

If you’re in insurance and wondering what the next version of your operating model looks like, join us in NYC on September 4. Register here →