Open banking is a technological revolution allowing secure industry interoperability. It is redefining people and working together, allowing individuals to share information, reduce costs and improve the customer experience provided financial institutions are prepared and willing to take advantage of this new opportunity.

Open banking is a collection of open standards, APIs, and data governance solutions that enable banks and consumers to use data meaningfully in the payment ecosystem. Driving changes to how businesses operate, making it easier for them to gain insight into their customers and their journeys. This gives businesses more control over their customer data and enables them to use it in new, more productive ways.

Open banking addresses challenges around security and privacy as the products are designed to help businesses manage customer data responsibly while also opening new opportunities for innovation in fields such as consumer lending and insurance. It is a key enabler of financial services innovation bringing new ideas, products, and services to market. Innovation in open banking has seen a massive bump, especially in the UK.

“Open banking gives you access to more data than ever before.

Therefore, learning to navigate the new data landscape to tap its

maximum potential for your organization is vital”.

Open banking ensures the meaningful use of data for business

Data is the new oil, and businesses can better understand their customers by leveraging their banking relationships. By providing more transparency on data usage and how it is used, banks can boost their ability to use data in meaningful ways that respond to consumer needs. Open Banking keeps data in one place and gives businesses real-time access to financial information. This means they can use it to gain insights into spending preferences and patterns, ultimately helping them target their marketing more effectively.

Open Banking means that every customer has access to their credit and debit card transactions, allowing customers to make purchases with greater control over their spending habits. These aids businesses make use of data meaningfully through more effective analytics and real-time personalized customer engagement. By offering a range of new tools, firms can build trust by proactively sharing sensitive information with consumers while empowering them to take control of their financial lives.

By offering an open banking solution, your Business can provide direct access to users’ bank accounts and reap the benefits of a broader customer base. Customers will get more relevant offers from different financial institutions at the POS. Affected businesses would be the ones that offer their customers high-value services (like those with sophisticated products like investments), niche products, or services for specific markets.

A LOOK INTO THE FUTURE OF FINANCE 2023

In the rapidly evolving landscape of finance, staying ahead means embracing the latest trends and technologies. Don’t be left behind, the future is now.

Understand and Build APIs to enhance customer experience

Through open banking, financial institutions are increasingly embracing APIs to better engage with their customers, creating more opportunities for them to transact online and make financial choices that streamline their daily lives. This allows customers to manage their finances in new and innovative ways.

Realizing that APIs are essential to customer engagement, financial bodies allocate more resources to keep their customers happy. That way you can better understand customers and grow your Business. You can use data across payments, devices, and platforms to improve customer experience, boost sales, and make better business decisions quickly and more efficiently by democratizing access to data.

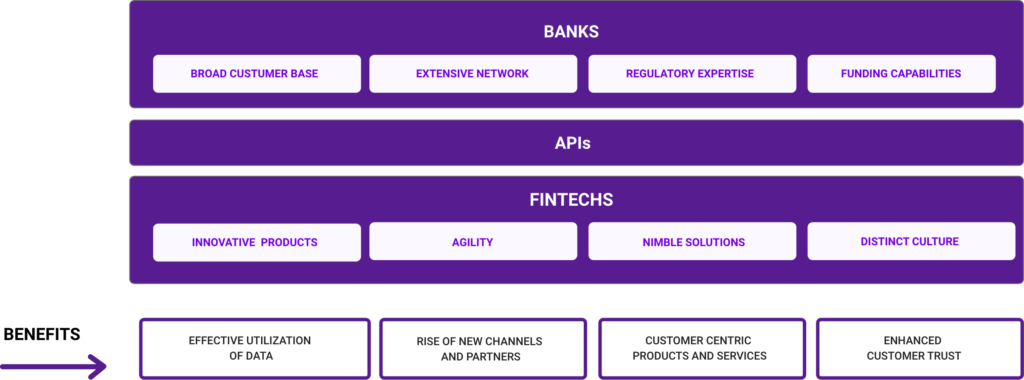

FinTechs: The enablers of Open Banking

Fintechs are often a part of an open banking initiative and are responsible for much of space’s innovation. They are often used interchangeably with start-ups that help to disrupt old financial services. Their expertise with data gives them an advantage they can leverage to create new business models and services that might not have otherwise been possible. Their skills make them essential in this new world where data is shared openly.

“FinTechs are essential in enabling open banking and creating better

relationships between customers, businesses, and banks.”

Open Banking’s new regulatory framework makes it easier for consumers to take control of their personal data and use it quickly, with or without permission. For this, banks must publish critical information about their business, the key benefits businesses will gain from the technology, the third-party applications they make available, and other relevant details.

Your financial management software should automate updating your bank and investment accounts, sync data between devices, and help you manage it all. Open banking brings with it great potential for financial institutions and individual customers. But it also creates challenges and opens the door to various risks.

Conclusion

Open Banking is a wave of change to revolutionize how people interact with banks and other financial institutions. This will make banking more inclusive, accessible, and faster, resulting in greater service levels for everyone. The new regulatory framework is giving businesses the tools to engage with customer data in new ways, making it easier for your business to understand where and how customers interact with your brand, what interests them, and what motivates them. It’s all about understanding the customer journey before they even get to your shop or website.

Open banking and APIs to create a seamless banking experience where consumers can see their financial data in one place and use it to make smarter choices. Thus, bringing together different parties – from banks to platform providers, new technology companies, and startups – ensures that customers get the best of all worlds. It aims to give everyone the tools they need to understand and manage their finances.