The FedNow® Service is a real-time payment service recently introduced by the Federal Reserve, designed to facilitate instant and direct settlements between banks. This means payment schemes for clearing, and settlement are streamlined, leading to faster, more efficient, and more secure transactions. In this blog post, we will compare The FedNow® Service and ACH (Automated Clearing House), the two main real-time payment systems in the United States. We will also discuss their key features, benefits, and drawbacks, and assess the impact of The FedNow® Service on other payment options like Venmo and PayPal.

On July 20, 2023, The Federal Reserve launched The FedNow® Service, its instant payment service. The FedNow® Service allows retail customers to send and receive money within seconds and is available 24×7. Unlike peer-to-peer payment services like Venmo and PayPal, which act as intermediaries between banks, The FedNow® Service directly settles transactions in central bank accounts. This is a significant development in the payments landscape, as it could potentially disrupt the dominance of peer-to-peer payment services like Venmo and PayPal.

Comparison of The FedNow® Service and ACH settlement times:

This graph shows the settlement times for The FedNow® Service and ACH payments. As you can see, The FedNow® Service payments are settled in real-time, while ACH payments can take up to three business days to clear.

Source: ACI Worldwide

Key Features

• Speed: The FedNow® Service is significantly faster than ACH. The FedNow® Service payments are settled in real-time, while ACH payments can take up to three business days to clear.

• Availability: The FedNow® Service is available 24×7, while ACH payments are only processed during business hours.

• Finality: The FedNow® Service payments are final, meaning that they cannot be reversed. ACH payments can be reversed up to two business days after they are sent.

• Fees: The FedNow® Service fees are expected to be lower than ACH fees.

Benefits

• Convenience: The FedNow® Service offers a more convenient way to send and receive money. Payments can be made instantly, regardless of the time of day or day of the week.

• Security: The FedNow® Service payments are more secure than ACH payments. The FedNow® Service uses a real-time gross settlement (RTGS) system, which means that funds are transferred directly from the sender’s bank account to the receiver’s bank account. This eliminates the risk of fraud or theft.

• Efficiency: The FedNow® Service can help to improve the efficiency of the payment system. By reducing the time it takes to settle payments, The FedNow® Service can free up capital for businesses and individuals to use.

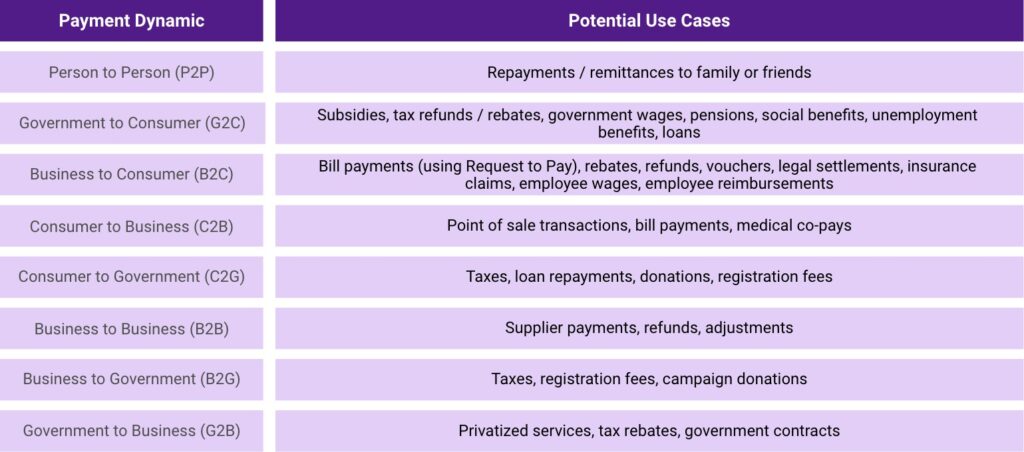

What are some potential use cases for real-time payments?

Real-time payment platforms support a variety of payment dynamics and use cases, including those shown in the chart below:

Source: ACI Worldwide

Drawbacks

Cost: Although the fees associated with The FedNow® Service are projected to be less, however the immediate setup costs for this new system will be more expensive than ACH. This is because The FedNow® Service is a newer system, and it requires prompt infrastructure spending to support it.

Reach: The FedNow® Service is not yet available to all banks and financial institutions. This means that not everyone will be able to use The FedNow® Service to send and receive payments.

Complexity: The FedNow® Service is a more complex system than ACH. This means that it may be more difficult for banks and financial institutions to implement.

A LOOK INTO THE FUTURE OF FINANCE 2023

In the rapidly evolving landscape of finance, staying ahead means embracing the latest trends and technologies. Don’t be left behind, the future is now.

Impact on Venmo and PayPal

• The FedNow® Service could offer faster settlement times. Currently, Venmo and PayPal typically take 1-3 business days to settle payments. The FedNow® Service could settle payments in real-time, which would be more convenient for users who need to access their funds immediately.

• The FedNow® Service could be more secure. The FedNow® Service is backed by the Federal Reserve, which means that it is subject to the same security measures as the U.S. banking system. This could make it a more attractive option for users who are concerned about the security of their financial information.

• The FedNow® Service could be more efficient. The FedNow® Service is designed to be more efficient than the current payment system. This could lead to lower fees for users.

It is still too early to say how much of an impact The FedNow® Service will have on Venmo and PayPal. However, the new service has the potential to disrupt the peer-to-peer payments market. Venmo and PayPal will need to innovate to stay ahead of the competition.

In addition, The FedNow® Service could also open new opportunities for businesses. For example, businesses could use The FedNow® Service to offer same-day payments to their customers. This could be a valuable way to improve customer satisfaction and boost sales. Overall, The FedNow® Service is a significant development that has the potential to change the way we send and receive money. It will be interesting to see how Venmo, PayPal, and other businesses respond to this new challenge.

Conclusion

The FedNow® Service is a new real-time payment system that offers many advantages over ACH, including speed, availability, finality, and fees. It is a more convenient, secure, and efficient way to send and receive money. It is especially well-suited for businesses and individuals who need to send money quickly, such as for online purchases or bill payments. It is still too early to say how much of an impact The FedNow® Service will have on Venmo and PayPal, but it is a significant development that could potentially disrupt the dominance of these peer-to-peer payment services.