In a world where convenience and flexibility are paramount, variable recurring payments (VRPs) have emerged as game-changers in handling routine financial transactions. But what exactly is VRP, and why does it matter? This article is your beginner’s guide, aiming to unravel the basics of VRP in straightforward terms.

What are Variable Recurring Payments (VRPs)?

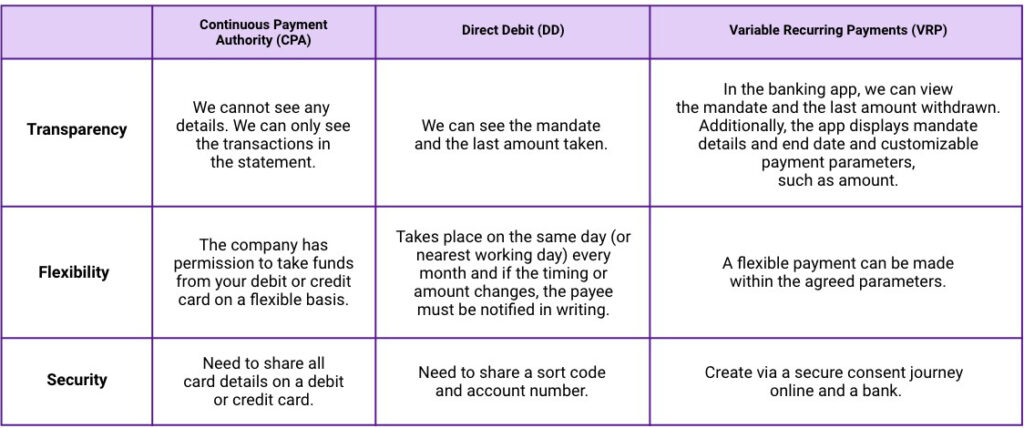

Variable Recurring Payments (VRPs) represent a recent payment innovation enabled by open banking APIs within the UK. VRPs securely link authorized payment providers to customers’ bank accounts, enabling payments within agreed limits. As a growing method in Open Banking, VRPs raise questions about their definition and practical use cases. They operate automatically regularly, offering flexibility, and stand out compared to Continuous Payment Authority (CPA) and direct debit in expediting fund transfers.

In contrast to direct debit’s pull-based model, VRPs use a push-based approach where the payer initiates the transaction. This sets VRPs apart from conventional direct debit, avoiding pulling funds from the payer’s account to the payees, as in utility transactions.

Key benefits to consumers

1. Enhanced flexibility and transparency: Consumers can swiftly and conveniently establish a VRP mandate through their preferred channels. This mandate can be easily viewed, modified, or canceled, giving users increased control.

2. Greater convenience: VRP mandates are linked to bank account details rather than card details, eliminating the need for constant updates when consumers acquire a new card or misplace one.

3. Reduced manual data entry: Setting up and modifying a VRP mandate involves fewer manual forms than alternative recurring payment methods, decreasing the likelihood of errors associated with manual data entry.

Key benefits to merchants

1. Cost efficiency: VRP, an account-to-account solution, does not incur the elevated costs or fees typically associated with card payments.

2. Enhanced security: VRP eliminates the need to store card information and incorporates Strong Customer Authentication (SCA), decreasing the risk of fraud and related costs.

3. Efficient cash flow management: VRP utilizes the Faster Payment Scheme to ensure considerably swifter settlement than alternative methods. This enables customers to gain real-time insights into their financial position.

Let’s see how VRP compares with Direct debit and CPA

VRPs break down into two types

1. Sweeping: The current UK regulations allow VRP to be used only in ‘sweeping’ use cases. VRPs for sweeping enable transferring money between two personal or business accounts under the same name. The account can be used for saving, investing, and repaying loans.

2. Non-sweeping: This type refers to VRPs between a customer and a business. The UK government does not mandate this, which offers enhanced flexibility and control in open banking transactions. Some of the use cases are Utility bills, Subscriptions, Investments, and Charity payments.

Conclusion

Although Direct Debits are currently more popular among businesses and banks than VRPs, the multitude of benefits offered by VRPs for users suggests an anticipated increase in VRP usage over the next few years. Stay tuned for the transformative impact of VRP on the ever-evolving landscape of financial transactions.