Compliance Support services streamline audits, reporting, and governance in BFSI.

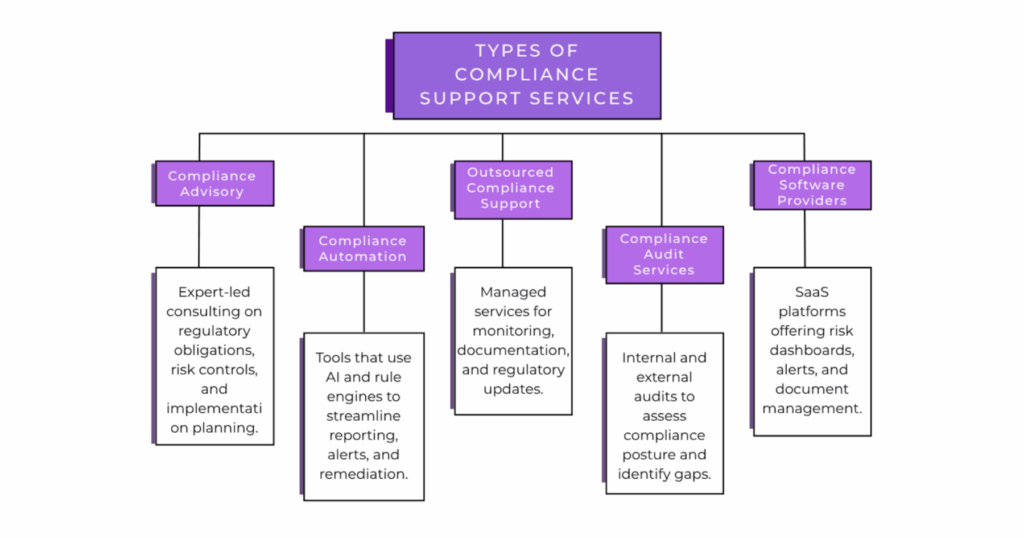

Compliance support refers to a set of services, tools, and frameworks that help organizations meet regulatory, legal, and operational compliance requirements. In financial services, these offerings reduce risk exposure, improve audit readiness, and simplify adherence to complex global standards through advisory, monitoring, and automation.

Detailed Definition & Explanation

In the financial sector, compliance support encompasses everything from regulatory compliance services and corporate compliance help to reg-tech platforms and compliance consultancy. These services ensure that institutions remain aligned with dynamic rules such as Basel III, MiFID II, Dodd-Frank, and AML/KYC mandates.

Modern compliance support models include compliance management software, automated reporting engines, advisory audits, and risk-mitigation controls, all designed to reduce manual overhead and increase traceability. Many firms also turn to outsourced compliance support for BFSI functions to manage cost and scale needs without sacrificing control. Compliance monitoring solutions often include real-time alerts, risk scoring, and audit documentation tools integrated with enterprise systems.

Platforms like FD Ryze combine AI-driven compliance support services with multi-agent automation, enabling banking and financial institutions to embed regulatory controls directly into workflows. These agents proactively monitor compliance triggers, escalate anomalies, and generate audit-ready documentation, supporting a shift from reactive reporting to proactive governance.

Why It Matters

Streamlines Regulatory Reporting and Reduces Manual Work

Compliance support services automate repetitive reporting tasks, freeing up compliance teams to focus on strategic oversight. Tools can match transactional data with regulatory schemas, generate standardized disclosures, and update compliance documentation in real time, reducing the risk of human error and reporting delays across banking, investment, and capital markets functions.

Improves Audit Readiness and Risk Transparency

With built-in monitoring and documentation features, compliance support systems enhance visibility into internal controls and regulatory adherence. This is especially valuable for audit preparation within internal control, risk, and legal departments, where traceability and evidence gathering are critical for both internal assurance and external regulator reviews.

Reduces Cost and Complexity through Smart Outsourcing and Automation

Financial firms that manage multiple regulatory frameworks benefit from reg-tech-enabled compliance outsourcing. This supports smaller compliance teams by automating monitoring workflows, escalating rule violations, and maintaining updated regulatory libraries without the overhead of managing in-house compliance infrastructure.

Embeds Compliance Logic into Core Financial Workflows

Intelligent compliance agents integrated into everyday financial workflows such as loan origination, trade surveillance, or KYC onboarding ensure that rule execution happens at the point of process. This reduces the need for post-facto checks and enables a shift from static policy enforcement to continuous, embedded compliance.

Real-World Examples

As regulatory pressures intensify and digital operations expand, financial institutions are investing in compliance support that is faster, smarter, and more integrated into day-to-day processes. These examples highlight how leading platforms are transforming compliance from a burden into a strategic function.

FD Ryze

FD Ryze offers AI-driven compliance support for financial services firms by embedding intelligent agents directly into operational workflows. These agents monitor for rule violations, automate regulatory reporting, and generate audit-ready documentation in real time, minimizing reliance on manual oversight and external consultants.

Clausematch

Clausematch provides a dynamic policy management platform for banks and insurers. Its compliance management system helps firms author, track, and version-control compliance policies while maintaining full auditability, especially during regulatory updates or enforcement changes.

Ascent RegTech

Ascent uses machine learning to automate the discovery and tracking of regulatory obligations. Its platform continuously monitors changing rules and delivers tailored compliance requirements to firms in finance and banking, reducing the cost and complexity of maintaining up-to-date controls.

What Lies Ahead

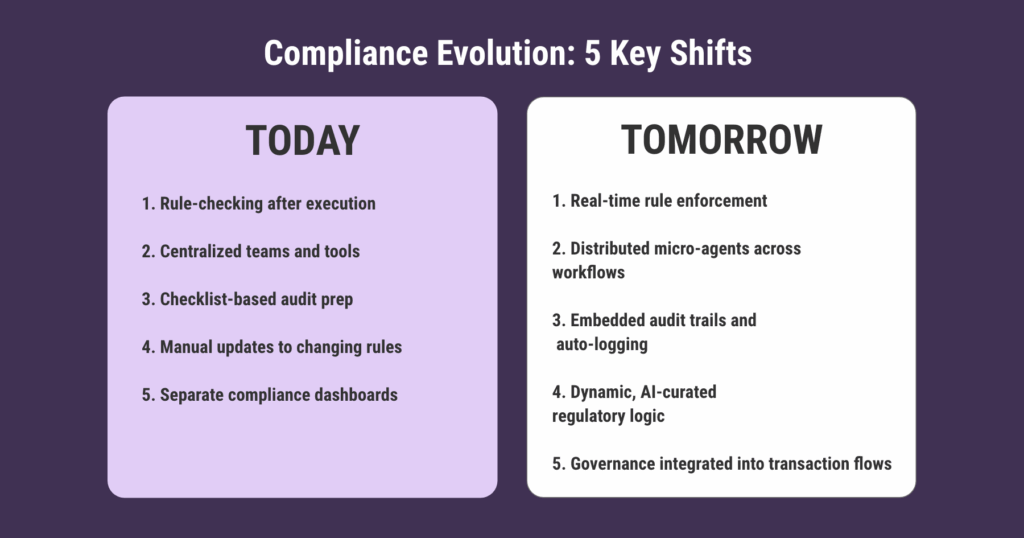

Compliance Will Move Closer to the Core of Digital Operations

As regulation becomes more intertwined with digital finance, compliance functions will be embedded at the API and service layer. This means every transaction, document, and interaction will carry regulatory context natively, requiring compliance platforms to evolve from dashboards to engines.

Predictive Compliance Will Anticipate Violations Before They Occur

With advancements in AI-driven compliance support services, future systems will not just detect breaches, they’ll anticipate them. Models trained on internal risk signals, external enforcement patterns, and process anomalies will surface risks before they materialize.

Custom Compliance Agents Will Become the Norm

Enterprises will deploy micro-agents specialized in different regulatory domains, such as anti-money laundering, consumer protection, or ESG. These agents will work collaboratively, managing complexity across jurisdictions without overwhelming internal teams.

Global Convergence Will Demand Multi-Jurisdictional Logic Engines

As financial firms operate across markets, frameworks will need to support cross-border compliance automation. This includes layering overlapping rules and resolving conflicts in real time, using logic trees and AI governance layers.

Related Terms

- Regulatory Compliance Services

- Risk Management

- RegTech

- Compliance Automation

- Governance-as-Code

- Audit Trail Systems