In Part 1 of this series, we explored how the Digital Operational Resilience Act (DORA) is reshaping third-party accountability across financial services, especially as enforcement enters a new phase in July 2025. What began as a regulatory framework is now an operational reality, with firms under pressure to demonstrate not just compliance intent, but measurable action.

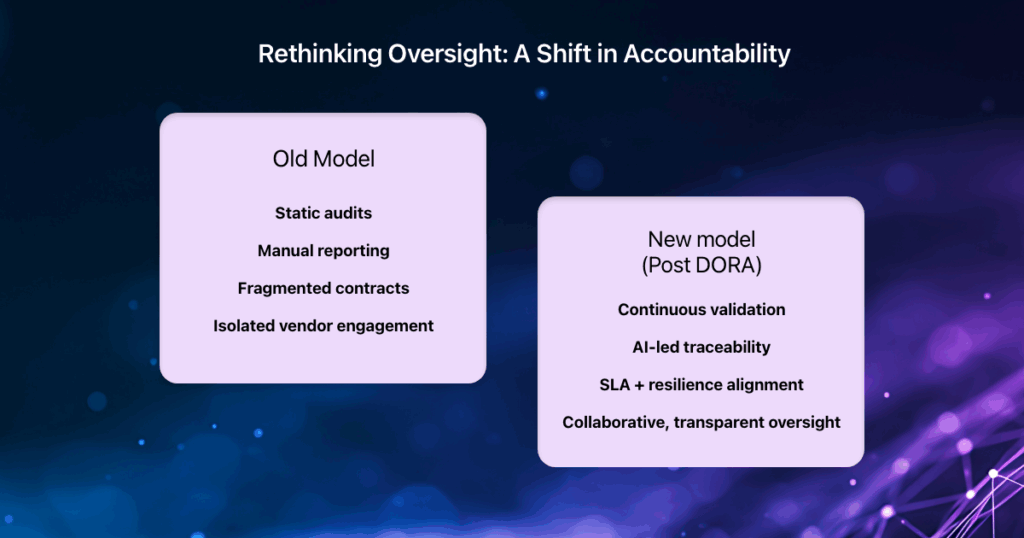

One of the biggest tests lies in oversight. DORA demands continuous risk assessment, real-time traceability, and audit-ready reporting across third-party ICT providers, many of whom sit outside an institution’s direct control. For firms still relying on siloed tools, static SLAs, and periodic due diligence, the gap between policy and practice is already showing.

Traditional vendor governance models weren’t designed for this level of scrutiny. They struggle with visibility across subcontracting chains, delay response timelines, and often leave audit trails fragmented or incomplete.

Regulators, however, are no longer interested in what firms say they would do in a crisis. They want to see what systems are in place, what actions are taken, and what proof exists, all in real time.

This shift from documentation to demonstrability demands a different approach to oversight, one that’s intelligent, adaptive, and proactive.

This is where Agentic AI enters the frame.

Agentic AI in Action: Rethinking Oversight from the Ground Up

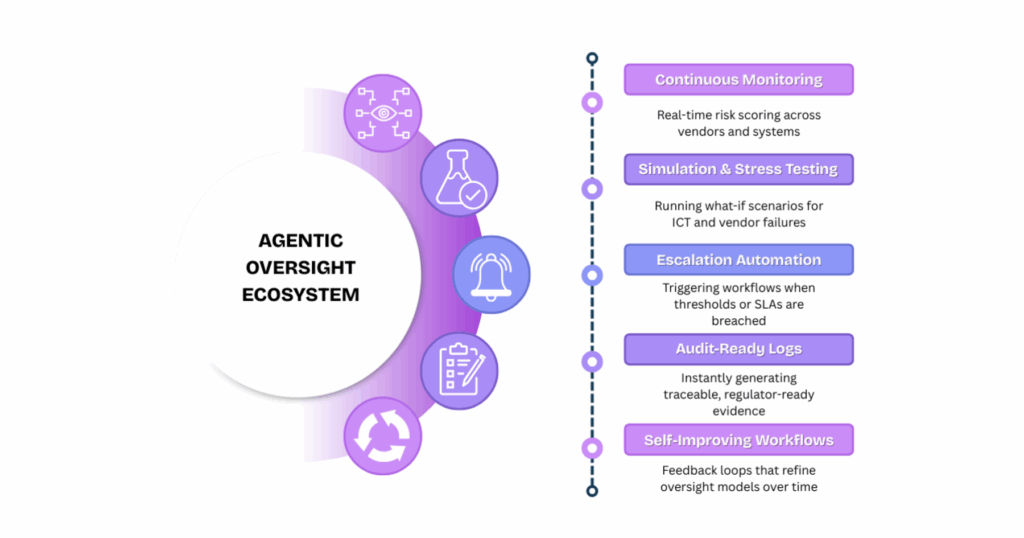

Agentic AI refers to intelligent systems that don’t just analyze data but act on it. These systems are goal-driven, adaptive, and capable of initiating decisions or workflows without constant human prompting. In a regulatory context like DORA, where timing, traceability, and real-time response are paramount, this is more just a technological advantage; it’s an operational necessity.

In practice, an agentic oversight system can:

- Continuously monitor ICT vendors across tiers, detecting performance degradation or SLA breaches as they occur

- Simulate disruption scenarios, like cloud outages or latency spikes, and test real-time response across the digital supply chain

- Auto-document every step in a machine-readable audit trail

- Flag anomalies, initiate escalations, or even trigger contract renegotiation workflows

- Integrate directly with existing risk, compliance, or legal systems for contextual insight

This level of autonomy, transparency, and traceability isn’t easy to achieve with legacy tooling or fragmented governance platforms.

Agentic platforms like FD Ryze unify oversight intelligence, connecting contracts, third-party systems, and regulatory workflows into one actionable ecosystem. From running stress-test simulations to generating regulator-ready evidence at the push of a button, these platforms can help financial institutions transform oversight into a living, traceable, and AI-enabled capability.

When agentic oversight becomes part of the operational fabric, institutions gain the clarity and confidence to manage third-party risk at scale.

Oversight That Works: Real-World Use Cases in Action

Agentic oversight may sound futuristic, but in practice, it’s already underway. Across financial services, leading institutions are rethinking how they manage risk, especially when it comes to vendor ecosystems that sprawl well beyond first-party walls.

A leading global bank, managing over 10,000 suppliers, has adopted an AI-powered vendor risk platform to centralize, score, and monitor third-party performance. By automatically analyzing financial health, SLA adherence, and reputational data, the bank reduced assessment time by 40% and proactively flagged elevated risk across 15% of its vendors, well before disruptions could escalate.

This kind of always-on visibility is exactly what DORA calls for: real-time, evidence-backed oversight that can be demonstrated on demand.

Meanwhile, Mastercard has taken a proactive stance on vendor oversight through its RiskRecon-powered Cybersecurity Alliance Program. By combining continuous monitoring, cyber risk ratings, and a shared platform for partners, the company empowers third parties to assess, benchmark, and improve their security posture in real time. This initiative not only strengthens individual vendor performance but elevates security standards across the broader digital ecosystem, transforming oversight into a shared, data-driven, and collaborative capability.

While not DORA-mandated, this approach embodies its intent, proving that visibility, accountability, and coordination across multiple layers of service providers isn’t just possible, it’s becoming the industry norm. These examples offer a blueprint for regulated firms seeking to evolve from static checklists to responsive, intelligence-led oversight.

What’s Next for Regulated Firms and Their Tech Partners

DORA’s message is clear: oversight cannot just be a paper trail; it needs to be a living, provable system. With regulatory scrutiny now sharpening around third-party governance, financial institutions and their vendors must rethink how they structure resilience at scale.

Agentic AI will play an increasingly central role in the months to come. Not as a one-off solution, but as an embedded layer of intelligence across operational workflows. For institutions, that means going beyond dashboards and static compliance reports. For vendors, it means becoming active participants in demonstrating trustworthiness and control.

What’s needed now is collaboration. Regulated firms and their technology partners must co-develop oversight ecosystems that are continuous, transparent, and simulation-ready. Because readiness isn’t about predicting every failure; it’s about proving, in real time, that your systems and partners can absorb disruption and remain accountable.

In this shift, intelligent platforms like FD Ryze can serve as the connective tissue, enabling firms to simulate third-party failures, log escalations, flag threshold breaches, and generate regulatory-ready evidence as events unfold.

The result? A stronger, smarter line of defense. Not just against risk but against regulatory lag, reputational fallout, and operational blind spots.

Have questions about what DORA’s enforcement means for your third-party ecosystem? Let’s connect.