In insurance, you don’t get the luxury of shutting systems down to modernize them. Policies must renew, FNOL must run, underwriting can’t pause, and compliance doesn’t wait for IT. The core of the business beats 24/7, which makes modernization feel a lot like operating on a heart that’s still beating.

What “Open-Heart Migration” Really Means

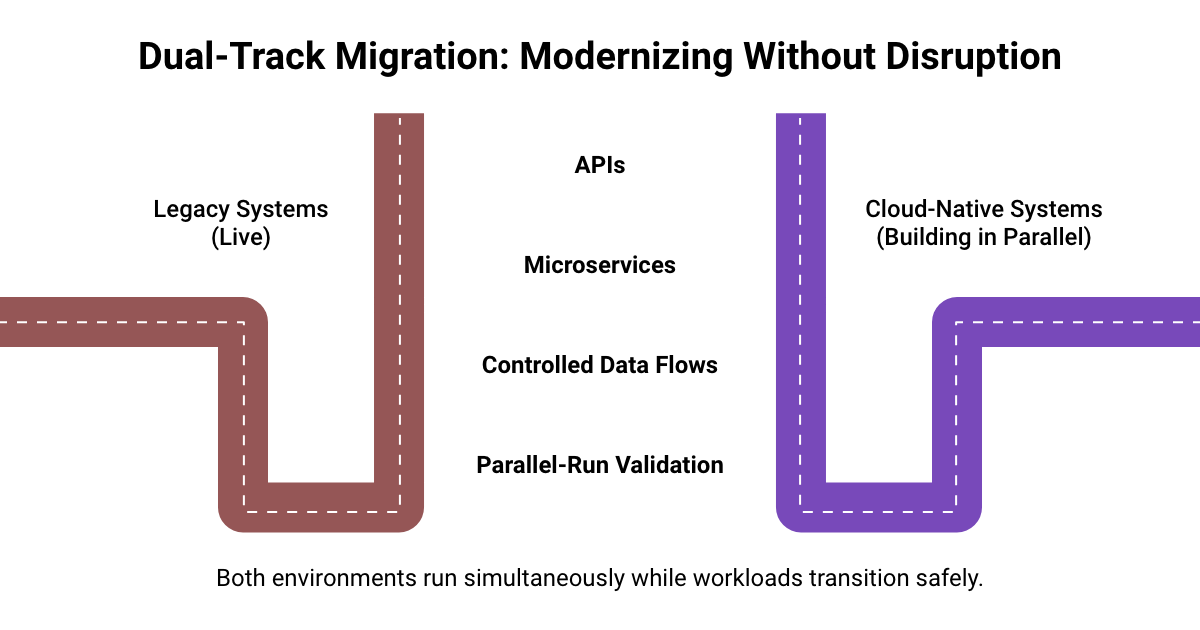

Open-heart migration means preserving all critical business flows while evolving the underlying technology. Underwriting, claims, billing, and regulatory processes continue uninterrupted throughout the transition. Bypasses take the form of microservices, APIs, and parallel-run environments that safely reroute traffic while new platforms come online. Monitoring vitals translates into mature DevOps practices, observability pipelines, and automated testing that surface issues before they cause disruption. And most importantly, the people leading the work need experience on both sides of the equation: the realities of insurance operations and the architecture of cloud-native systems.

Best Practices for Zero-Downtime Modernization

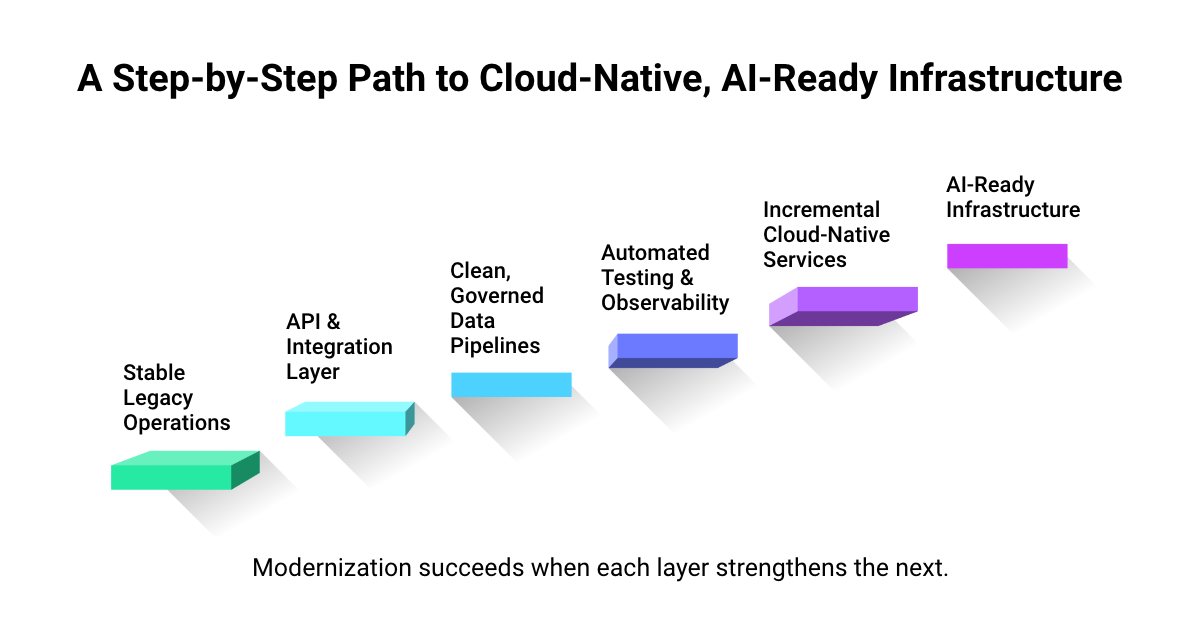

Modernizing insurance systems without pausing operations requires discipline, sequencing, and an architecture built to absorb change. Here are the practices that keep the business running while the foundation shifts underneath it:

1. Keep a Parallel Environment Running Until the New One Proves Itself

The safest way to modernize is to let the legacy and cloud environments coexist for a period of time. This gives teams space to validate workflows, compare outputs, and resolve issues without putting underwriting, claims, or billing at risk.

How to do it:

- Run “shadow mode” for key transactions (claims intake, policy issuance) and compare outputs daily.

- Maintain identical datasets in both environments to spot discrepancies early.

- Set clear thresholds: e.g., X days of zero variance before moving traffic.

- Route a small percentage of real traffic to the new system to test behavior under live conditions.

<br>

2. Build API Layers Before You Move Anything Important

Legacy systems tend to be tightly coupled. Creating an API layer loosens those dependencies and gives you controlled entry points. It’s the difference between rewiring a house with the power on and switching to a safely designed breaker panel.

How to do it:

- Identify the top 5–10 legacy integrations that break most often and API-enable those first.

- Standardize payloads (even if the legacy system can’t) so downstream services stay consistent.

- Use the API layer to “front” legacy functionality while rewriting it behind the scenes.

- Log every API call aggressively for 60–90 days to detect invisible failure patterns.

3. Move the Data First

Most modernization failures stem from inconsistent, inaccessible, or poorly structured data. Establishing clean, governed pipelines early gives everything else—workflow modernization, AI, analytics—a more predictable path forward.

How to do it:

- Start with one high-volume dataset (e.g., claims, policy, billing) and build pipelines around that.

- Introduce data contracts so teams stop pushing malformed data into new systems.

- Run automated reconciliation jobs between old and new databases to test alignment.

- Tag and classify unstructured documents early; don’t wait until AI use cases demand it.

4. Automate the Testing, Not Just the Deployment

Insurance systems are interconnected in ways even long-time teams underestimate. Automated regression testing ensures that a small change in one area doesn’t silently affect rating, policy issuance, or downstream reporting.

How to do it:

- Build regression packs around actual business scenarios (endorsements, cancellations, reinstatements).

- Use synthetic workloads to simulate peak cycles; think renewal season or disaster-driven claim spikes.

- Add negative test cases specifically for compliance workflows; they’re often overlooked.

- Set up nightly “change drift” reports to show where outputs diverge across environments.

5. Test Failure Scenarios Before They Happen

Resilience isn’t theoretical. Running planned failure tests in controlled environments helps teams understand how the new architecture responds under stress, long before real volumes and real customers depend on it.

How to do it:

- Simulate what happens when a downstream system (like billing or fraud scoring) goes offline.

- Test latency extremes. Insurers often forget this until call centers start complaining.

- Randomly shut down non-critical microservices to ensure the system fails gracefully.

- Validate queues, retries, and circuit breakers under realistic load conditions.

6. Migrate in Small, Well-Defined Chunks

Rather than lifting entire processes at once, move one capability at a time: a claims intake step, a pricing function, an underwriting rule library. Smaller transitions stabilize faster, and the business feels fewer shocks along the way.

How to do it:

- Define “migration slices” based on business impact, not system components.

- Start with functions that have the least regulatory exposure; save billing and FNOL for later.

- Design each slice so it can be isolated and corrected quickly, without forcing changes across the entire process.

- Treat every cutover like a release: pre-checks, post-checks, and stabilization windows.

7. Have a Rollback Strategy That Protects Business Continuity

Even the best-planned migrations need a safety valve. A rollback plan ensures that if something behaves unexpectedly in production, you can revert quickly without interrupting policy issuance, claims intake, or compliance runs. In insurance, rollback is the control that keeps modernization reversible, predictable, and safe.

How to do it:

- Maintain pre-cutover snapshots or restore points for every migration slice.

- Keep rollback scripts tested and ready, not theoretical.

- Align rollback triggers with business SLAs, not technical comfort levels.

- Establish a pre-agreed “stop and revert” window with all downstream teams.

- Document and rehearse rollback steps the same way you rehearse deployments.

Migration for AI: Why the Surgery Is Worth It

Apart from stabilizing legacy systems, modernization unlocks capabilities insurers can’t reach today. A cloud-native foundation creates room for real-time data, scalable compute, and the kind of orchestration modern AI depends on.

Here’s what changes once the groundwork is in place:

- Claims can be triaged, summarized, and validated in minutes.

- Underwriting gains access to cleaner data and richer signals.

- Pricing models adapt to shifts in loss behavior instead of lagging behind them.

- Compliance becomes more predictable with traceable, audit-friendly workflows.

- Customer interactions become more personal and more accurate.

When modernization is done correctly, AI stops being a series of disconnected pilots and becomes part of everyday insurance operations.

The High-Value Path Forward

The real measure of modernization is whether the business stays stable while the architecture evolves. Which is why the most effective transformations usually start with focused, high-value workflows rather than full-system rewrites.

That’s exactly how a leading P&C carrier used FD Ryze to break through a long-standing bottleneck in their Loss Run operations. Instead of ripping out core systems, they introduced a cloud-native AI extraction pipeline on a private cloud, achieved 95% accuracy, delivered reports 3× faster, and strengthened data security, all through a phased rollout designed to keep day-to-day operations intact.

This kind of modernization doesn’t make headlines, but it moves the business forward in ways that matter.

If you’re ready to modernize without risking the heartbeat of the business, visit Cloud and Infrastructure Engineering | Fulcrum Digital Our team can support you through each step of the transition.

![[Aggregator] Downloaded image for imported item #232033](https://9011056c.delivery.rocketcdn.me/wp-content/uploads/2025/12/Migrating20Legacy20Insurance20Systems_Blog_Fulcrum-Digital_Hero.jpg)