With the November 2025 deadline looming, discover how US institutions can transform a technical mandate into a market advantage.

ISO 20022 is the new global standard for structuring and exchanging payment messages: a “common language” designed to make transactions richer in detail, more accurate, and easier to process across borders. For financial institutions, it promises faster payments, improved compliance, and a future-proof foundation for emerging payment technologies. But like any large-scale transformation, the benefits depend on timely, effective adoption.

ISO 20022 adoption of for cross-border payments rose from 27% in April 2024 to 32.9% by year-end; slow progress toward full coverage before CBPR+ coexistence ends on 22 November 2025 for cross-border FI-to-FI payment instructions. For US institutions, the timeline is just as urgent: CHIPS completed its migration on 8 April 2024, and the Fedwire Funds Service went live with ISO 20022 on 14 July 2025.

One example of early readiness is BNY Mellon. As a CHIPS participant, BNY completed its ISO 20022 cutover on April 8, 2024, supported by a cross-functional team, extensive training (both internal and client-facing), and rigorous testing with industry peers via Swift’s MyStandards platform and “Buddy Bank Testing.” Their early, structured preparation ensured a smooth cutover and improved processing efficiency, showing that readiness is not just possible, but achievable.

Yet, a global survey projects that only 72% of SWIFT-member banks will migrate by the deadline, leaving nearly 5,000 international banks potentially non-compliant. The November 2025 cutoff won’t move; so identifying and solving last-mile roadblocks now is critical.

In this piece, we’re breaking down the major technical, operational, regulatory, and change-management hurdles that can stall even well-planned programs and how to address them before they derail compliance.

1. Outdated Infrastructure, Costly Upgrades

Many financial institutions still rely on decades-old payment infrastructure that wasn’t designed for ISO 20022’s data-rich message formats. Retrofitting these systems often means complex integrations, costly middleware, and lengthy testing cycles. This is where financial services technology consulting can help chart a modernization roadmap that balances speed, cost, and minimal disruption to ongoing operations.

2. Messy Data, Risky Mappings

ISO 20022 demands far more granular, structured data than existing standards. Inconsistent field usage, incomplete records, and mismatched mappings between old and new formats can cause message rejections and reconciliation errors. Addressing this early through robust data governance, enrichment tools, and targeted remediation plans is essential to avoid downstream payment failures.

3. People & Process Lag

The shift isn’t just technical. It transforms how teams handle payments day-to-day. Without targeted training and new process workflows, even well-configured systems can underperform. Structured change management and role-specific enablement help ensure teams can fully leverage ISO 20022’s richer datasets for faster resolution and better customer service.

4. Testing Delays, Vendor Holds

Coordinating testing across multiple internal systems, payment rails, and external vendors is a time-intensive effort. Late vendor deliverables or insufficient test coverage can compress timelines dangerously close to the deadline. Partnering with a financial services technology consulting firm that offers end-to-end test orchestration reduces risk and keeps migration plans on track.

5. Compliance Misinterpretations

While ISO 20022 is a technical standard, compliance implications vary across jurisdictions and payment types. Misinterpreting regulatory guidance or overlooking specific local variations can trigger costly delays. Engaging dedicated compliance support ensures interpretations are accurate, requirements are met, and implementations withstand regulatory scrutiny.

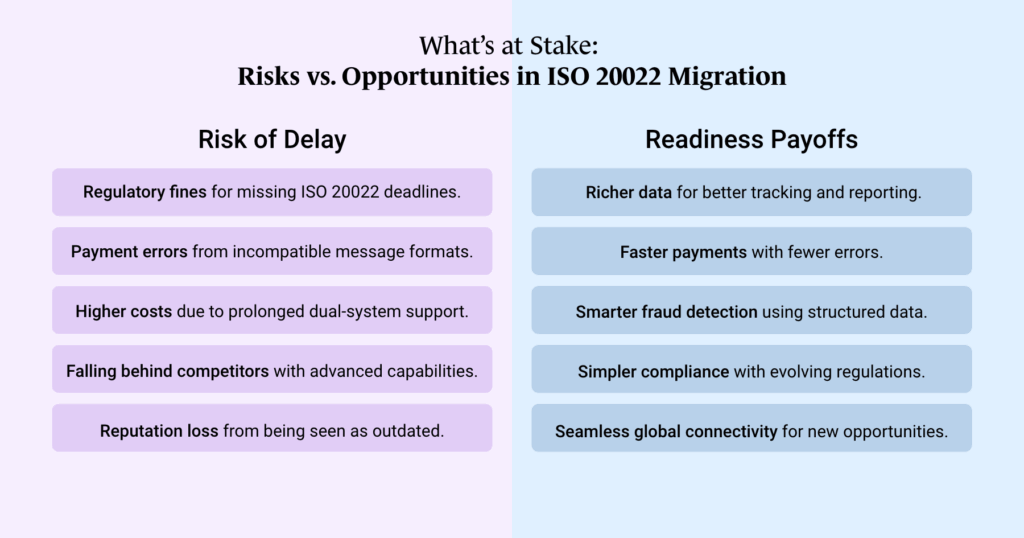

ISO 20022 isn’t just another compliance deadline; it’s the foundation for a new era of payments transparency, interoperability, and innovation. For US financial institutions, the November 2025 SWIFT cutover is a hard stop, and late adoption could mean operational disruption, regulatory exposure, and lost market credibility.

The remaining months demand a clear-eyed plan that treats the shift as a strategic modernization initiative, not a box-ticking exercise. Done right, it can unlock richer analytics, sharper fraud detection, and frictionless cross-border transactions. With the right blend of technical execution, process alignment, and regulatory precision, what might seem like a complex transition can become a decisive competitive advantage.

Connect with us today to map your ISO 20022 journey and turn a compliance milestone into a lasting advantage.