Call Recording is not new to insurance companies. Customer calls have been recorded for many years for compliance or quality monitoring purposes. These interactions- often in the form of phone calls, are crucial for understanding client needs, processing claims, and providing assistance. However, the manual analysis of these calls can be time-consuming, error-prone, and limited in scope. This is where AI call analytics steps in, promising to transform how the insurance industry handles customer interactions.

Artificial intelligence (AI) is used for Call Analytics to scan call transcripts of conversations for relevant keywords and phrases for accurate lead scoring, cater to specific customer needs, and cross-selling.

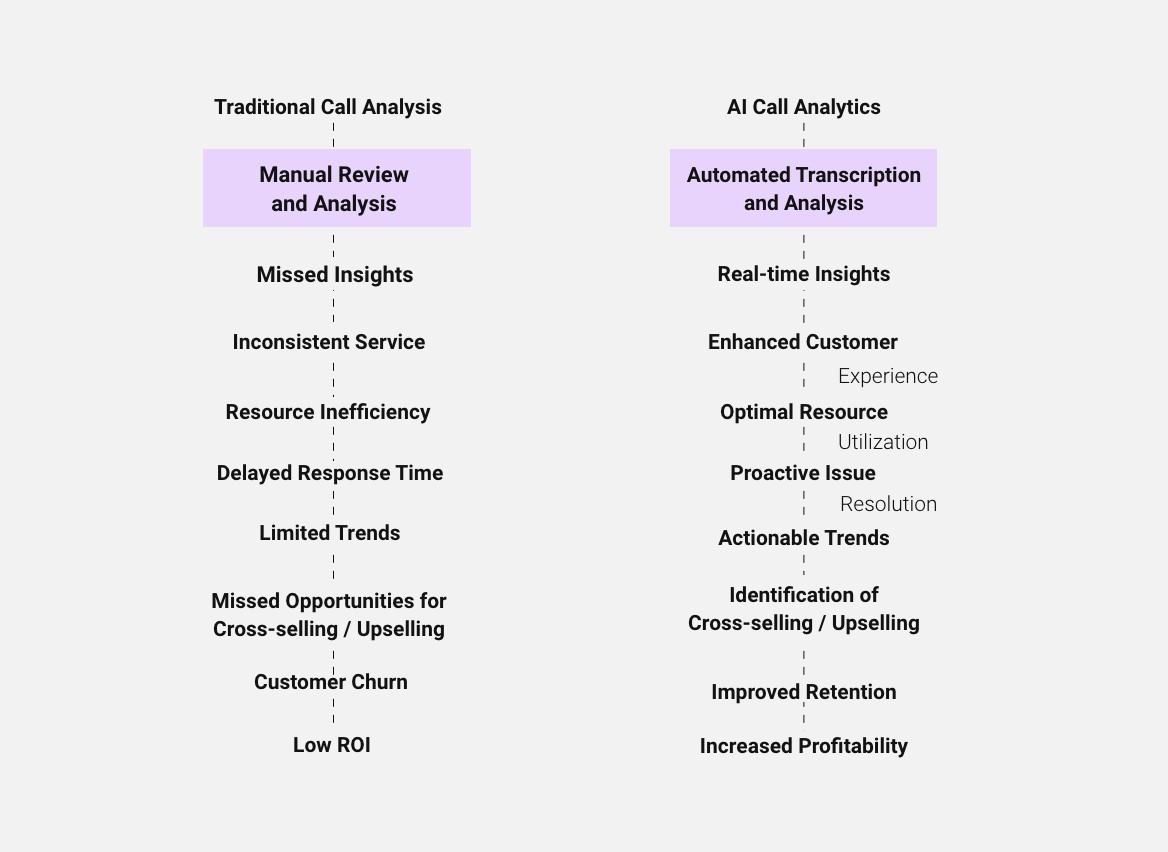

Let’s understand the problem statements in the insurance industry: traditionally, insurance companies have relied on manual call analysis to gain insights from customer interactions. This method has its limitations:

1. Time-Consuming: manually listening to and transcribing numerous calls is a time-consuming process, diverting valuable human resources away from more strategic tasks.

2. Subjective Interpretation: human analysis is susceptible to bias and subjective interpretation, leading to inconsistent insights and decisions.

3. Limited Data Sampling: due to the time constraints, only a fraction of calls can be analyzed, potentially missing out on critical trends and insights.

4. Compliance and Quality Control: ensuring regulatory compliance and maintaining service quality through manual methods can be challenging.

Examples:

Consider an insurance company that receives thousands of calls daily. A customer, Sarah, calls in to inquire about a claim she filed a week ago. Traditional call analysis might involve manually listening to the recorded call, understanding the context, and extracting relevant information. This process can take time, and Sarah’s frustration grows as she waits for answers. With the current method, her call could be mishandled, leading to dissatisfaction and potential churn.

This is what the solution looks like considering the above example

The Process?

Your call tracking system identifies the caller’s location and routes the call to the nearest contact center. AI identifies customer sentiments like if she is frustrated or happy with the help of the voice tone and the usage of words and pauses etc., enabling representatives to tailor their responses and resolve issues promptly, improving satisfaction.

The result?

This AI interaction analytics converts raw customer data from multi-channel interactions in the form of structured data. To achieve that, the solution offers insights into the customer responses like whether it’s a frustrated response or a happy response by identifying the voice tone and the word usage.

How does this work?

It works by automatically capturing and analyzing the entire customer interaction in real-time, formulating a tailored next-best-action guidance message on the agent’s desktop handling the call.

Multi-channel (voice and text) interactions such as emails, online forms, chat, social media, phone calls, surveys, and more can also be monitored.

Below is a simplified diagram representing the impact of AI call analytics across the insurance industry worldwide:

The main components of a call analytics strategy include:

• Call Recording

• Call Reporting

• Interaction Analytics

• Business Intelligence

• Compliance Systems

AI solutions analyze customers’ driving behavior based on the data collected by smartphone apps or plug-in solutions. This allows insurers to offer innovative insurance products which are better suited to user needs, such as “pay how you drive,” which encourages and rewards responsible behavior.

EMERGING TRENDS IN AI AND ML TECHNOLOGIES

Embark on a journey into the future of AI and ML, unraveling its impact across sectors and shaping technology responsibly.

What are the broader benefits:

Here’s your insight into the biggest benefits of a call analytics platform:

• Get an Overview of Your Business Operations

• Real-Time Insights into Problems

• New Training Opportunities

• Track Your Growth and Helps You Evaluate and Optimize Marketing Campaigns

• Identify Missed Opportunities

• Gives You Deeper Insights About Your Customers

• Improves Call Handling and Lead Conversions

Conclusion

The adoption of AI call analytics marks a turning point for the insurance industry, transcending the limitations of manual call analysis. Insurance companies that embrace this technology stand to benefit from enhanced customer experiences, streamlined processes, improved compliance, and a competitive edge in an ever-evolving market. As AI continues to reshape the landscape, Mumbai’s insurance professionals have a prime opportunity to lead this transformation and pave the way for a more efficient and customer-centric future.