Why Most Grocery Giants Are Mistaking Surface Automation for Real Transformation

From customer service bots to personalized loyalty programs, big box retailers have plenty of reasons to believe they’re riding the crest of AI transformation. The metrics are reassuring: faster query resolution, higher CSAT scores, and growing participation in digital rewards ecosystems. On paper, the future looks automated, intelligent, and profitable. A showcase of what big box retail technology can supposedly achieve when powered by AI…

But beneath the surface of these well-packaged gains lies the simple truth that most of what’s being called “Agentic AI” in the grocery and consumer products space is little more than customer-facing convenience, dressed up as innovation. The dashboards may glow green, but the operational engine remains stubbornly unchanged.

This piece unpacks why the most visible successes around AI in retail are often the least transformative, and why the illusion of AI transformation in retail needs closer inspection.

The Mirage of Progress is Convincing

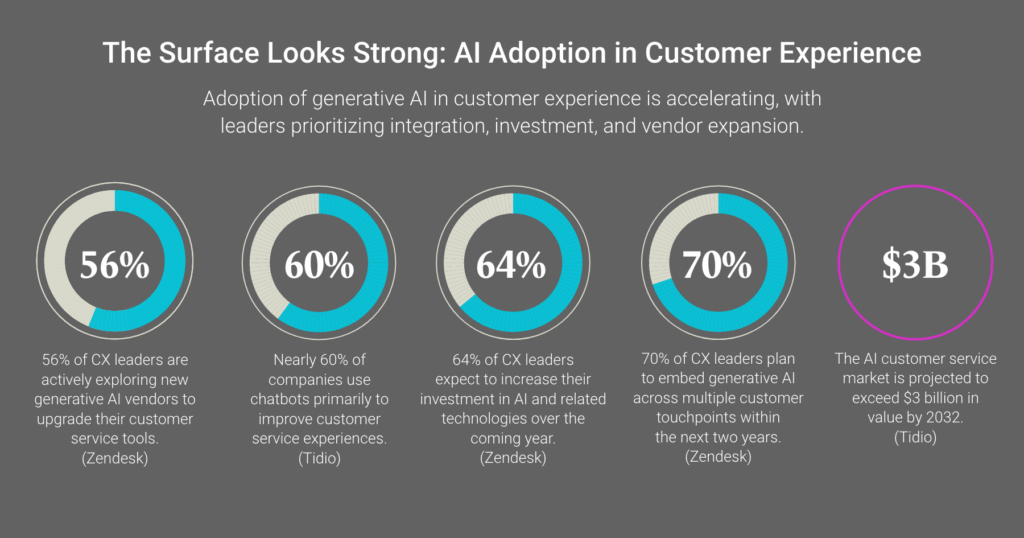

By most outward measures, the AI era has arrived in grocery and consumer retail. According to recent retail AI adoption statistics, over 65% of retailers have deployed some form of customer service AI, from chatbots and voice assistants to self-checkout support and real-time loyalty triggers. Investments in customer experience innovations also continue to climb, with more than 60% of CX leaders likely to increase their investments in enhanced AI capabilities within the next year.

The results, at first glance, are hard to argue with and customer experience automation in retail has delivered measurable improvements across major touchpoints. CSAT scores have improved in key interaction zones. Automated agents are resolving more queries on first contact. Personalized incentives are boosting participation in loyalty programs. And the staffing model, once brittle and dependent on in-store personnel, has found digital buffers that promise both flexibility and cost containment.

Internally too, it all appears to add up. Vendors deliver glossy case studies showing measurable uplift in engagement. Analyst briefings highlight “AI maturity curves,” further contributing to the rising executive misconceptions about AI maturity in retail. For leadership teams under pressure to modernize, it’s the kind of validation that feels both comforting and conclusive.

What makes these surface-level wins surrounding AI in grocery chains so seductive is their simplicity. Customer service automation doesn’t require a rewire of the business because it layers on top. It’s quick to procure, relatively painless to deploy, and often siloed enough to avoid friction across departments. The return is fast. The risk is low. And the optics are excellent.

This is the mirage. And it’s not because these gains aren’t real. They are. It’s because they represent only the most visible and least complex edge of what AI, especially Agentic AI, could actually do. It’s transformation that stops at the threshold. And for many grocery giants, it’s just enough to believe they’ve arrived, without ever leaving the lobby.

Why Big Box Brands Stop Here

It’s tempting to assume that retailers stall at surface automation because they don’t understand the next layer. But the truth is more uncomfortable. They stop here because the next layer touches everything they’ve learned to protect.

For many large chains, especially those managing high-volume inventory in complex environments like AI in grocery stores, customer-facing AI is attractive not just because it delivers quick wins, but because it lives in isolation. It doesn’t ask supply chain systems to talk to inventory platforms. It doesn’t require finance, merchandising, and logistics to agree on shared data standards. It doesn’t threaten legacy architectures or reassign decision-making power. It performs well in the spotlight and leaves the shadows untouched.

By contrast, operational AI in big box retail, the kind that reallocates inventory in real time or orchestrates fulfillment across borders, demands a level of cross-functional coordination that most organizations are structurally unprepared for. Procurement cycles get longer. Stakeholders multiply. Accountability blurs. The more intelligent the system, the more disruptive it becomes to the very silos that keep large retailers stable.

And then there’s the politics. Moving beyond the dashboard means inviting AI into core processes. The ones owned by senior leaders, governed by legacy KPIs, and kept afloat by years of workaround logic. These are not just technical systems; they’re power structures. And when transformation risks rebalancing who holds the steering wheel, even well-intentioned retail technology innovation can stall.

This is why the illusion persists so elegantly. The smoke is engineered to stay outside the engine. And so long as the interface looks intelligent, few will ask what the machine underneath is actually doing.

Agentic Intelligence in Action

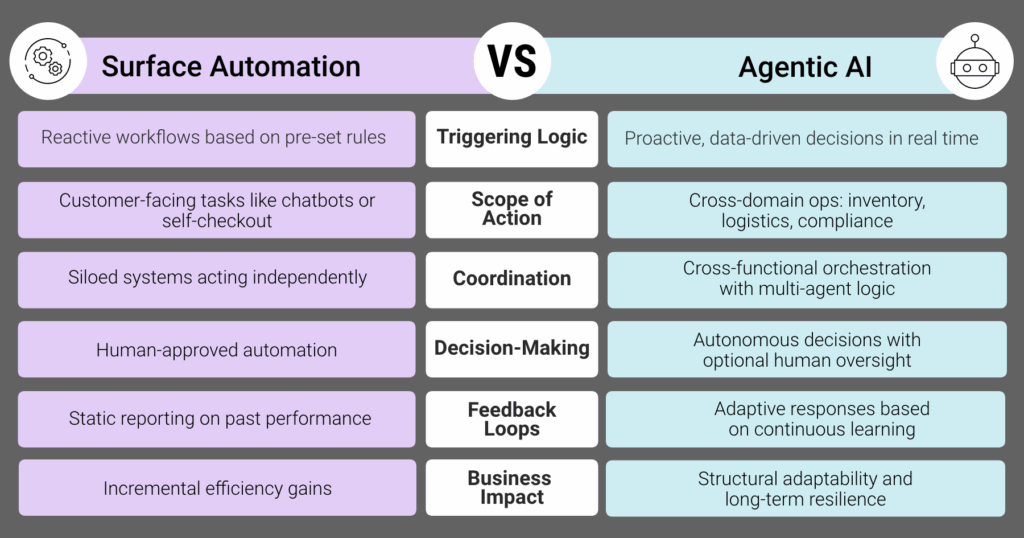

So what really is the difference between Agentic AI and automation in retail?

If today’s retail AI lives in the showroom—polished, impressive, and highly visible—then Agentic AI belongs in the engine room. It’s not there to entertain; it’s there to adapt. It’s where intelligence meets operational complexity and decisions are made in motion, not after the fact.

Consider Target’s AI-powered Inventory Ledger, a system that makes billions of weekly demand predictions to anticipate stockouts before they occur. The program now covers more than 40% of the company’s assortment, doubling its reach in just two years. It doesn’t wait for alerts from store staff; it acts autonomously, ensuring availability where it matters most.

Or look at Old Navy’s RADAR system, which uses a blend of RFID and AI to offer real-time shelf-level inventory visibility across over 1,200 stores. The system guides store associates to fulfill online orders with speed and accuracy, while also reducing stockouts and fulfillment errors.

These are no longer just proof-of-concept experiments. They’re live deployments of enterprise AI for retail. A demonstration of agentic intelligence and systems that sense, decide, and act with minimal human intervention. And while they emerged in general retail, the implications for grocery are immense, especially for those exploring how grocery retail AI can extend beyond inventory tracking to true operational orchestration.

Imagine a fresh food chain that not only tracks expiry dates but dynamically reallocates perishable inventory across locations to minimize waste. Picture an AI layer that can detect cold-chain disruptions, flag compliance risks, and re-route deliveries in real time, without waiting for human escalation. All of these are just natural extensions of what retailers like Target and Old Navy have already achieved.

This is what retail digital transformation is meant to look like. Not just customer-facing polish, but operational systems that think, adapt, and act across the value chain.

When you shift enterprise AI investment from just the interface and into the operational core, the entire system becomes more adaptive, more resilient, and more valuable. It stops being a digital assistant and starts becoming a strategic co-pilot.

It’s Not About Looking Modern. It’s About Being Ready.

We’re no longer talking about chasing innovation for its own sake. We’re talking about competing in a market where volatility is constant, customer expectations are fluid, and operational slack is no longer a luxury.

Agentic AI isn’t a marketing upgrade or a customer service fix. It’s an operating model shift. It rewards companies that are willing to rethink coordination, restructure accountability, and embed intelligence where the decisions actually happen.

Grocery and consumer product retailers have a choice: continue widening the gap between AI dashboards vs real operational transformation or start wiring the intelligence into the engine.

Those who choose the latter won’t just react faster. They’ll recover faster. Adapt faster. Scale faster. While others wait for alignment or manual workarounds, these companies will already be making the next move, with systems that coordinate in real time, not on delay.

If you’re ready to move beyond surface retail automation and build real operational intelligence, let’s talk.