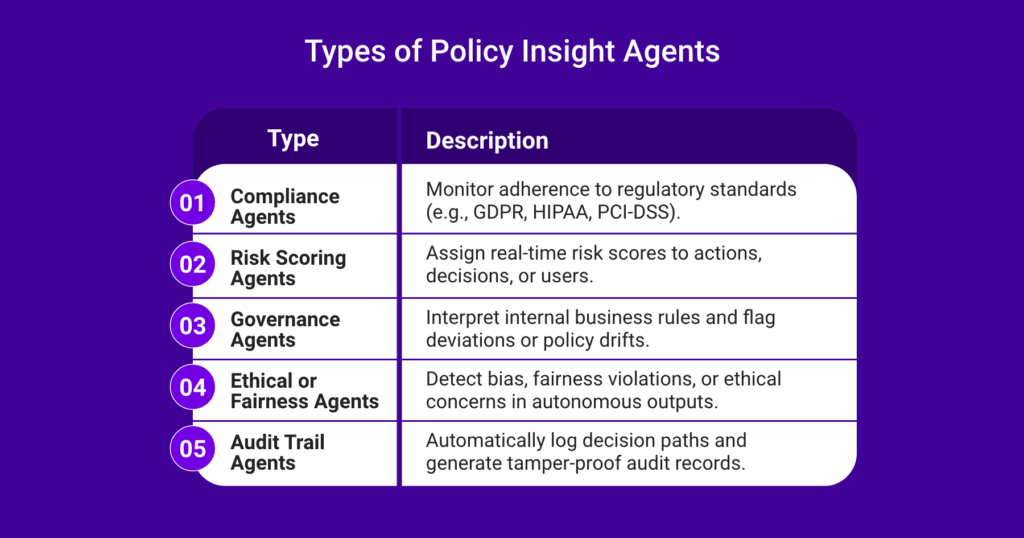

Policy insight agents are autonomous agents ensuring real-time compliance in AI-driven enterprise workflows.

A policy insight agent is an autonomous AI agent that interprets, applies, and monitors policy rules across enterprise systems. These agents provide real-time visibility into compliance, decision-making, and risk alignment—without requiring manual oversight or rule-checking.

Detailed Definition & Explanation

In an agentic AI environment, a policy insight agent acts as a self-directed interpreter and enforcer of business, legal, operational, or technical policies. Unlike static compliance scripts or traditional rule engines, these agents operate continuously—analyzing live data, assessing actions against policy models, and triggering interventions when violations, risks, or exceptions are detected.

They work across structured (databases, forms) and unstructured inputs (emails, chat logs), bringing context-aware decisioning to distributed workflows. They can also document reasoning, suggest remediations, and escalate based on risk or role hierarchies.

Policy insight agents in agentic AI systems are built on a combination of:

- Policy-as-code frameworks (e.g., Open Policy Agent/OPA)

- Context-aware signal ingestion (e.g., telemetry, identity, environment variables)

- LLM-enhanced interpretation layers, which allow the agent to handle natural language policies, ambiguous scenarios, and evolving business logic.

- Decision engines that use rules, thresholds, or probabilistic reasoning to assess compliance or policy alignment.

- Trigger modules that auto-initiate workflows, remediation steps, or human-in-the-loop reviews.

For example, in a claims system, a policy insight agent may intercept a payout instruction, reference underwriting rules, calculate fraud risk, and block execution—while routing the case to a human adjuster with a full contextual summary.

Why It Matters

1. Reduces Manual Policy Drift

In insurance or BFSI, agent-led governance ensures underwriting rules, pricing models, or eligibility criteria are followed—even when humans or systems evolve. Agents monitor decision logs and system updates, continuously comparing behavior against policy baselines to flag deviations.

2. Enables Real-Time Compliance

In ecommerce, agents detect violations of shipping policies, promotional terms, or refund timelines and act immediately—saving costs and reputational damage. They parse real-time transactional data via API streams and apply policy logic to identify infractions the moment they occur.

3. Supports Ethical AI & Bias Auditing

In higher education, policy agents ensure scholarship, admission, or grading decisions made by AI systems are transparent, bias-monitored, and explainable. These agents audit AI outputs using fairness constraints, demographic rules, and model interpretability layers.

4. Aligns Distributed Teams with Central Policies

In global consumer brands, agents ensure cross-market operations (e.g., sourcing, pricing, content moderation) comply with brand, legal, and regional mandates. They sync with internal policy repositories and validate cross-functional workflows by role, geography, and policy tier.

5. Provides Explainability for Audits and Regulators

In financial services, agents log each decision’s logic path, attached data, and triggering policy, offering audit-ready clarity and traceability. Each action is accompanied by an auto-generated explanation, complete with timestamps, rule references, and alternative path replays.

Real-World Examples

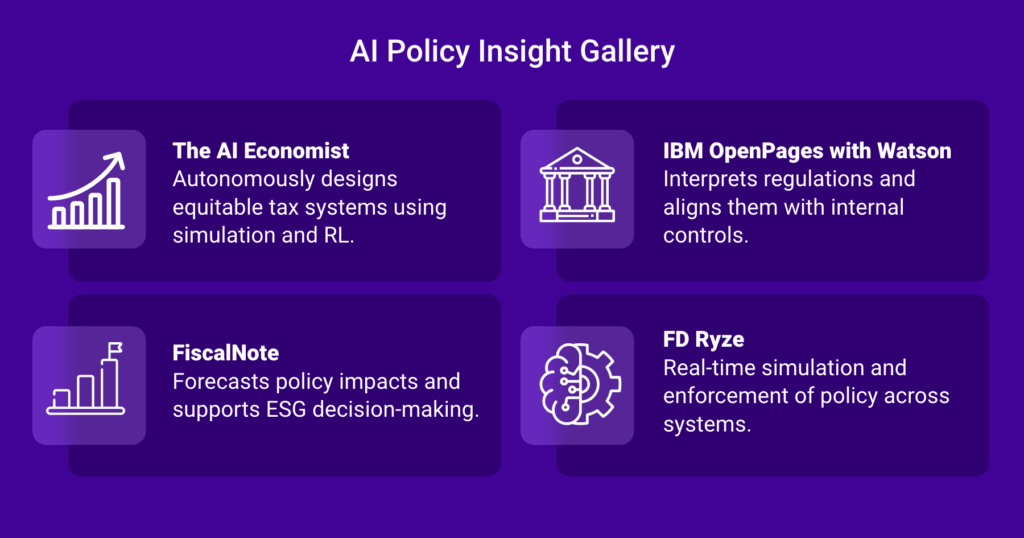

The AI Economist

The AI Economist, an agentic AI system developed by the AI Economist Researchers at Salesforce and the University of California, Berkeley, autonomously designs tax policies to balance economic equality and productivity. Using deep reinforcement learning, the system simulates dynamic economies and learns optimal tax strategies without predefined economic models.

IBM OpenPages with Watson

IBM OpenPages with Watson is an AI-powered Governance, Risk, and Compliance (GRC) platform that functions as an early example of a policy insight agent. By integrating natural language processing through Watson, it autonomously interprets complex regulatory updates and maps them to an organization’s internal control framework. The system identifies potential compliance gaps, suggests policy adjustments, and helps prioritize risk responses.

FiscalNote

Widely used by businesses and advocacy groups, FiscalNote functions as a real-world agentic system for policy analysis and decision support. It uses machine learning to evaluate the potential impact of policy decisions, comparing new bills with historical data and forecasting outcomes. Its tools support strategic planning, ESG compliance, and risk mitigation by providing timely, data-driven insights.

FD Ryze

FD Ryze’s policy insight agent operates as an autonomous, domain-specific intelligence layer within the platform, designed to interpret, simulate, and enforce organizational and regulatory policies across complex digital ecosystems. By leveraging real-time data ingestion and context-aware reasoning, the agent evaluates policy implications, flags compliance risks, and recommends optimal actions aligned with internal governance and external mandates.

What Lies Ahead

1. Dynamic Policy Inference

LLMs will help agents infer intent even when policies are vague or in flux—enhancing governance flexibility. Enterprises must ensure policies are stored in machine-readable formats and augmented with metadata to enable semantic reasoning. This will reduce bottlenecks in policy implementation, especially during regulatory changes or when policies differ across jurisdictions.

2. Policy Swarms at Runtime

Enterprises will deploy fleets of specialized agents (e.g., fairness, finance, legal) that consult one another before greenlighting high-risk decisions. Policy agents will operate as multi-agent systems, coordinating over message buses or shared memory layers like LangGraph or AutoGen. This distributed approach increases decision quality and minimizes blind spots in governance-critical actions.

3. Self-Updating Policy Models

Agents will subscribe to regulatory or internal change feeds, adapt rules on-the-fly, and validate new behaviors in sandbox environments. To support this, enterprises must establish versioned policy registries, test harnesses, and rollback mechanisms. This capability enables faster compliance with evolving standards without risking production integrity.

4. Audit-First Architecture

Systems will evolve to log policy agent activity at the infrastructure level, making compliance proactive rather than forensic. Agents will emit structured logs tied to each decision, integrated with observability stacks like OpenTelemetry or Splunk. This transforms compliance from a passive check to an active, verifiable layer of enterprise infrastructure.

5. Explainability as a Service (EaaS)

Enterprises will expose policy agent decisions through APIs, dashboards, and customer-facing explainers—turning trust into a product feature. This requires agents to be embedded with natural language generation (NLG) capabilities and access to causal decision graphs. The result: transparent decision support for users, regulators, and internal teams, improving adoption and accountability.

Related Terms

- Policy-as-Code

- Compliance Agent

- Autonomous Governance

- Digital Trust Layer

- Explainability Agent

- Risk Scoring Agent

- OPA (Open Policy Agent)