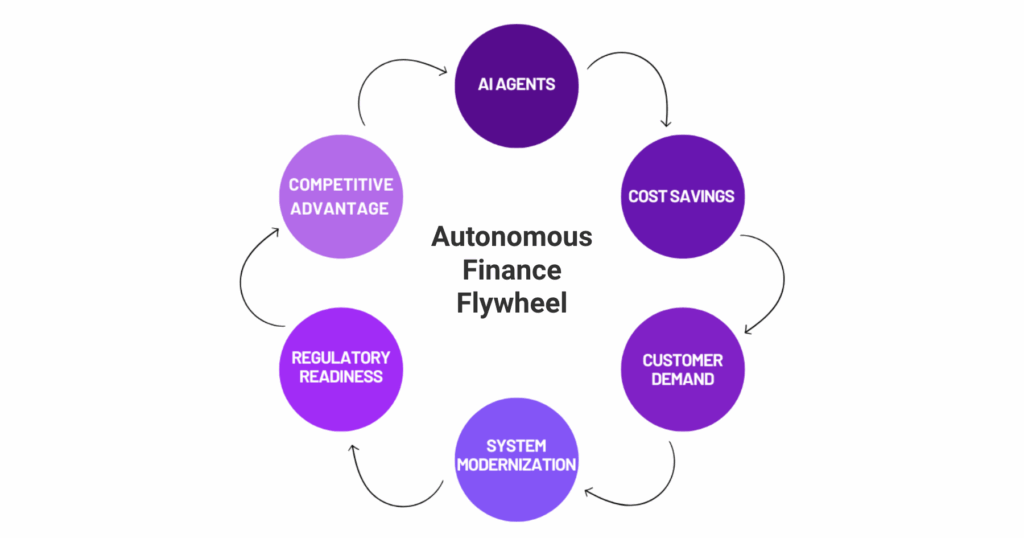

According to recent reports, over 75% of U.S. financial institutions are already deploying some form of autonomous finance, moving from self-operating budgeting tools to AI-led risk systems. What was once a speculative future is now becoming the operational backbone of modern banks, fintech platforms, and digital-first financial institutions. Whether it’s real-time payments, fraud detection, or generative risk modeling, the shift is more structural than theoretical.

What’s Driving the Shift?

Cost Efficiency: Autonomous systems are cutting operating costs by 35–50%, streamlining everything from reconciliation to servicing.

Generational Demand: Gen Z and Millennial users now dominate digital banking and expect fully automated experiences in wealth and expense management.

System Interoperability: Legacy upgrades are enabling embedded finance, tokenized payments, and quantum-secure transactions, accelerating the need to replatform.

Always-On Infrastructure: With FedNow and RTP now powering over 1,300 U.S. banks and billions in instant payments, AI agents finally have 24/7 audit-ready infrastructure for autonomous decisions.

Regulatory Alignment: Governance and auditability frameworks are maturing, easing the path to enterprise-scale AI deployments.

Competitive Leverage: Firms that adopt early are seeing better customer retention, faster innovation cycles, and lower error rates.

This transformation is increasingly architectural, not just technical. Entire institutions are being redesigned around agents that can perceive, decide, and act: whether it’s reconciling a payment, flagging compliance risk, or personalizing a product offer based on behavioral data.

At Fifth Third Bank, the modernization of core payment systems is turning into a case study in agility. Mastercard is pushing the boundaries of faster, tokenized commerce. Firms like Morgan Stanley and Itaú are rethinking how trust, transparency, and AI strategy intersect at scale. While State Street’s work in blockchain and tokenization continues to shape how institutions approach infrastructure-level innovation.

But autonomy brings its own complexity.

How do you maintain security and control when decisions are being made at machine speed? What guardrails are needed for quantum-safe protocols and blockchain-native systems? And how do financial institutions redesign themselves, not just their tech, to thrive in this new operating model?

These are the kinds of questions set to unfold live at TechXchange 2025.

From real-time agentic AI demos to panels on quantum-led transformation, TechXchange offers a rare chance to see what the next generation of finance looks like in action. With leaders from Mastercard, Morgan Stanley, Fifth Third Bank, Itaú, and beyond, the conversations go deep into design, risk, and value creation.

The future of finance isn’t a keynote. It’s happening on the floor.

Join us in NYC on September 4 to see how the smartest financial systems of tomorrow are already working today. Register now →