The insurance industry has been around for centuries, but with the rise of digital technologies, the industry is undergoing significant changes. By leveraging customer data and analytics, insurers can identify opportunities to cross-sell additional products and services to existing customers, resulting in increased revenue and customer satisfaction.

Cross-Selling

Ever added products to your shopping cart when prompted by a retailer at checkout? That is cross-selling. In the financial services industry, a bank selling a savings product to an existing client with a mortgage is an example of cross-selling. Within the beauty industry, a hair stylist might sell an additional conditioning treatment to a client who’s come in for a cut and blow dry. Cross-selling offers a simple, effective way to boost sales revenue without pressuring your customers. It’s a soft marketing technique that targets prospects already interested.

One of the key benefits of cross-selling is the ability to increase revenue by selling additional products and services to existing customers. Insurers can use customer data to identify potential cross-selling opportunities and tailor their offerings to meet each customer’s specific needs. This targeted approach can lead to higher conversion rates and increased customer loyalty.

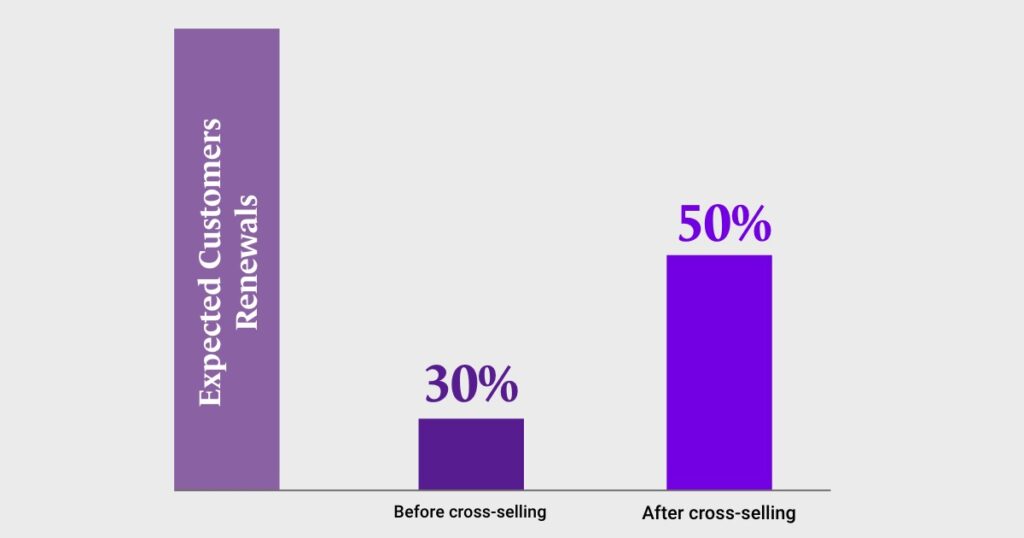

Cross-selling is an essential strategy for insurers to increase revenue and improve customer retention. By using data analytics and chatbots, insurers can identify patterns and trends in customer data and offer personalized product recommendations to their customers. An Accenture study reports insurers could boost customer retention by up to 30% by cross-selling additional products to existing customers. Cross-selling and personalization technologies are shifting how insurers interact with their customers. A study by EY found cross-selling increases customers’ renewal likelihood by up to 20%.

Personalization technologies

Personalization technologies, such as chatbots and machine learning algorithms, enable insurers to deliver tailored recommendations and customized offers based on individual preferences and behaviors. By using predictive analytics and telematics, insurers can offer customized risk management services and tailor insurance policies.

These tools enable insurers to provide customized recommendations and offers to individual customers based on their unique needs and preferences. These technologies are not limited to large insurers. Smaller companies also leverage these tools to improve customer engagement and drive growth. In fact, according to an Insurance Journal survey, 65% of small and midsize insurance companies plan to increase technology investment in the coming years.

FUTURE-PROOF YOUR LIFE WITH INSURANCE TRENDS FOR 2024

Explore how the insurance industry is evolving to meet the changing needs of businesses. Dive into the key trends shaping 2024 and beyond!

Implementing these technologies, however, requires a comprehensive understanding of data management and analysis. Insurers must be able to collect and analyse large volumes of data to identify patterns and trends that can inform cross-selling and personalization strategies. In addition, data privacy and security must be a top priority to protect sensitive customer information.

Some of the most popular brands like Amazon, Spotify, and Netflix generate substantial revenue through personalized content. Amazon suggests items based on your previous purchases and items on your wish list. Spotify users rely on personalized playlists that are curated for them based on what they’ve listened to before.

Insurance Technologies and Digital Transformation: An Inextricable Link

The insurance industry is undergoing rapid digital transformation driven by new technologies and shifting customer expectations. An Accenture survey found 87% of insurers believe Artificial Intelligence (AI) will significantly transform the industry in the next three years. AI and machine learning technologies can improve risk management, fraud detection, and claims processing. In addition, blockchain technology enhances transparency, reduces fraud, and streamlines claims processing.

Chatbots and other conversational interfaces can provide personalized product recommendations, real-time support, and claims processing. According to a McKinsey report, insurers that invest in digital transformation can expect a 15-20% increase in productivity and a 20-30% increase in revenue growth.

A Deloitte study found 58% of insurance customers prefer digital channels, such as mobile apps and online portals. Despite the benefits of cross-selling and personalization technologies, insurers must use these tools ethically and transparently. Insurers should communicate how customer data is used and ensure customers can opt out of marketing or promotional communications.

Conclusion

Cross-selling and personalization technologies are key drivers of revenue, customer engagement, and cost reduction in the insurance industry. By leveraging customer data and analytics, insurers can deliver tailored experiences that meet the unique needs and preferences of each customer. To succeed in this effort, insurers must invest in the right tools, talent, and customer communication strategies to effectively leverage these technologies.

The potential benefits of cross-selling and personalization technologies are significant. According to a recent study, insurance companies that leverage these technologies can increase revenue by up to 20% and reduce customer churn by up to 15%.

As we look to the future, we expect to see even more disruption and innovation in the insurance industry as insurers leverage technologies like AI, machine learning, and blockchain to improve risk management, reduce fraud, and provide more personalized products and services to their customers.