Takaful’s Global Rise: Redefining Insurance in a Digital and Ethical Age

Insurance is being redefined, not just by technology but by values. As the world faces growing concerns around economic inequality, social responsibility, and digital trust, the demand for financial systems that prioritize transparency and community has never been higher. In this context, Takaful, the Islamic model of cooperative insurance, is emerging as a globally relevant framework, offering a blueprint for how insurance can be both socially conscious and commercially viable.

Built on the principles of mutual aid, shared risk, and ethical fund management, Takaful operates fundamentally differently from conventional insurance. It replaces the insurer-client divide with a participant model, where surplus funds are redistributed, not retained as profit. What was once viewed as a religious or regional product has now captured the attention of a global financial ecosystem seeking alternatives that align with ESG values, inclusive growth, and ethical investment.

The numbers tell part of the story:

- The global Takaful market was valued at USD 36.6 billion in 2024 and is projected to nearly double to USD 75 billion by 2033.

- It represents a small but growing share—about 0.5% of the USD 7.2 trillion global insurance industry—but is expanding at a CAGR of 8.3%, significantly faster than many traditional insurance lines.

- The Middle East and Africa (MEA) region leads this growth, contributing more than 85% of global Takaful premiums, with Saudi Arabia, UAE, and Bahrain at the forefront of regulatory innovation and digital adoption.

But what truly sets Takaful apart in today’s context is its resonance with the moment. It reflects a broader shift in finance from transactional to relational, from opaque to transparent, from extractive to inclusive. As digital tools such as AI, blockchain, and embedded platforms redefine what insurance can do, Takaful is proving that ethical finance can be scalable, competitive, and future-ready.

This blog explores how the Middle East is not only modernizing Takaful through InsurTech innovation but positioning it as a globally relevant model for the next era of insurance.

Takaful’s Market Momentum: A New Growth Trajectory

Takaful is no longer just about meeting Shariah compliance. It is fast becoming a strategic pillar in the GCC’s economic diversification and financial inclusion agendas. The market is gaining serious traction, with Saudi Arabia leading the region as Takaful contributions surpassed USD 1.2 billion in 2024. The UAE is close behind, with annual growth nearing 16%, while Bahrain and Kuwait are emerging as high-potential markets, driven by regulatory agility and increasing digital adoption.

What’s fueling this momentum? Policy reform and regulatory innovation. Bahrain’s Central Bank (CBB) has created a forward-looking digital sandbox where Takaful operators can pilot AI-based underwriting, usage-based models, and blockchain-powered claims—all within a controlled, low-risk environment. Meanwhile, Saudi Arabia’s SAMA has introduced dedicated innovation labs as part of its Vision 2030 Financial Sector Development Program. These labs promote InsurTech collaboration and fast-track regulatory approvals, positioning the kingdom as a Takaful innovation hub.

Three key forces are driving this growth:

- Rising Consumer Trust: Transparent, ethical financial models are resonating with both Muslim and non-Muslim customers seeking values-driven alternatives.

- Government Backing: Takaful aligns closely with national agendas on financial inclusion, unlocking incentives, licensing reforms, and public-private partnerships.

- Digital Transformation: Scalability challenges that once held Takaful back are being resolved through AI, blockchain, and insurtech platforms, redefining how products are priced, distributed, and managed.

With digital-first strategies and regulatory support aligning across the region, Takaful is not just growing but redefining what inclusive, tech-enabled insurance looks like in the GCC.

Breaking Barriers: How Technology is Reshaping Takaful

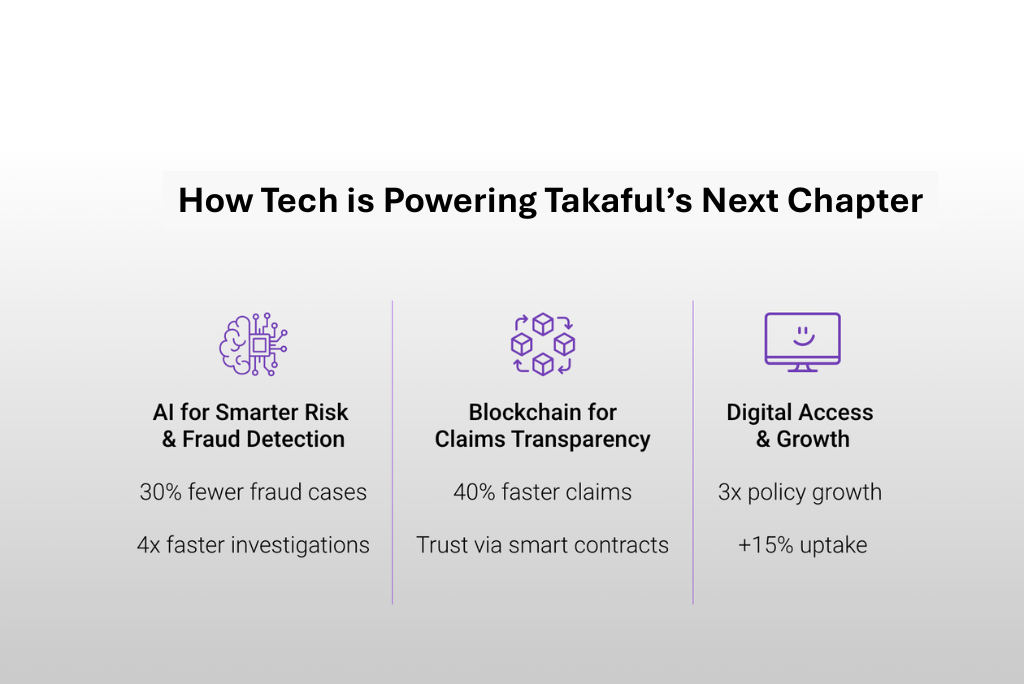

AI-Powered Risk Assessment & Fraud Prevention

AI is now central to enhancing underwriting accuracy and combating fraud. Over 50% of insurers globally use AI-driven underwriting, resulting in up to a 30% reduction in fraudulent claims and investigation times sped up by 4x. For instance, UAE-based Takaful Emarat’s AI system flagged more than USD 400,000 in suspicious claims within months, safeguarding community funds while accelerating claim settlements.

Blockchain for Transparency & Smart Contracts

Blockchain technology strengthens transparency by recording every transaction on an immutable ledger, preventing fund misuse. Salaam Takaful, in collaboration with Fasset, launched a blockchain-enabled health claims platform that cut claims processing time by 40%, while Bahrain’s Central Bank actively supports blockchain pilots through its regulatory sandbox, fueling innovation with robust governance.

Digital platforms are also transforming distribution by bypassing traditional intermediaries. Mobile apps, AI chatbots, and micro-Takaful products are expanding reach, especially among younger and underserved populations. Malaysia’s Beem Takaful reported a threefold increase in policy uptake after launching its digital platform, while UAE providers saw a 15% annual growth in individual policies in 2023, driven by seamless mobile onboarding and digital-first strategies.

Looking Ahead: The Next Frontier for Takaful

The next five years will be critical in determining whether Takaful remains a regional niche or rises as a mainstream alternative to conventional insurance. Industry projections estimate the global Takaful market could reach USD 35 billion by 2028, growing at a CAGR of 15%+ across key GCC markets. This growth is fueled by several emerging trends:

- Embedded Takaful: Fintech firms are increasingly integrating Takaful offerings directly within banking, e-commerce, and payment ecosystems, making insurance seamless and accessible at the point of sale. This shift unlocks untapped markets and enhances customer convenience.

- Cross-Border Standardization: Efforts to harmonize regulations across GCC countries are underway, paving the way for scalable, unified Takaful products that transcend borders and regulatory fragmentation.

- AI-Driven Personalization: Advanced data analytics and AI will enable hyper-personalized Takaful policies that adapt to individual lifestyles, behaviors, and risk profiles, delivering tailored coverage and pricing.

With rising consumer demand for products that are both Shariah-compliant and digitally accessible, Takaful is well-positioned to lead the insurance industry’s next wave of innovation.

The Future of Ethical Insurance

Takaful is moving beyond its traditional role to become a scalable insurance model that delivers clear business value across diverse markets. The real opportunity lies in leveraging technology to streamline operations, improve customer engagement, and create transparent, flexible products that appeal to a broad audience, regardless of geography or faith.

As digital tools break down barriers, Takaful providers who focus on scalability, innovation, and operational excellence will not only expand their market reach but also set new standards for sustainable growth in the insurance industry worldwide. The future of ethical insurance is about unlocking business potential through trust, technology, and adaptability.