Your Next Customer Isn’t Human

The next major disruption in retail isn’t a new app or loyalty program. It’s the simple fact that shoppers may no longer be the ones doing the shopping.

With the rise of AI agents in retail—software that can scan, compare, and purchase products on behalf of consumers—the buying journey is quietly shifting from human to algorithm. These agents operate on prompts, not preferences. They don’t browse, hesitate, or get swayed by banner ads. They act.

Walmart is already laying the groundwork for this shift. In a quiet but significant rollout, the retailer introduced a GenAI-powered shopping assistant within its iOS app. Users can now input natural language prompts like “I need ingredients for chicken tacos” or “Help me shop for back-to-school supplies on a budget.” The assistant responds by assembling product bundles, filtering inventory in real-time, checking dietary or price constraints, and enabling one-click checkout—all without a traditional search.

What sets Walmart’s move apart isn’t just the assistant, it’s the infrastructure behind it. With a deep SKU catalog, proprietary LLMs trained on Walmart-specific retail logic, and access to real-time store inventory and logistics data, the company is essentially turning its app into an autonomous shopping API, powered by the kind of digital transformation technology that enables scale, speed, and system-level decision-making.

This isn’t a future bet, it’s an operational shift. And a wake-up call for every consumer brand navigating digital transformation in the consumer goods industry. If your product can’t be discovered, parsed, and matched by AI agents, it might never be seen at all.

Here are six ways this agent-led shift is fueling the retail industry’s digital transformation, and what it means for the brands trying to stay in the cart.

1. AI Agents Don’t Browse. They Execute.

When humans shop, they scroll, compare, get distracted, add to cart, remove from cart, hesitate, and repeat. AI agents don’t do any of that. They operate with intent, not impulse. Give them a prompt—“gluten-free snacks under $10 with next-day delivery”—and they’ll find the best-fit products based on that exact criterion. No homepage, no sales funnel, no room for splashy campaigns or clever copy.

For consumer brands, this marks a dramatic shift in how product visibility is earned. Discovery no longer happens through browsing. It happens through prompt-to-purchase execution, and that means the traditional real estate of retail (the shelf, the homepage, the carousel) is losing its influence.

Klarna’s AI-powered shopping assistant, built on OpenAI, now serves 150 million users and is already responsible for handling two-thirds of the company’s customer service chats and millions of shopping interactions. It doesn’t surface top sellers. It surfaces top matches.

Walmart’s assistant takes this even further, skipping the search bar altogether in favor of conversational shopping. The prompt is the journey.

Retailer Implication:

If your product isn’t optimized to match agent-driven prompts, it won’t even make the list. Literally. This is the era of algorithmic intent, where AI and retail intersect through prompts, precision, and product data. Your content needs to meet that moment with clarity, specificity, and structure.

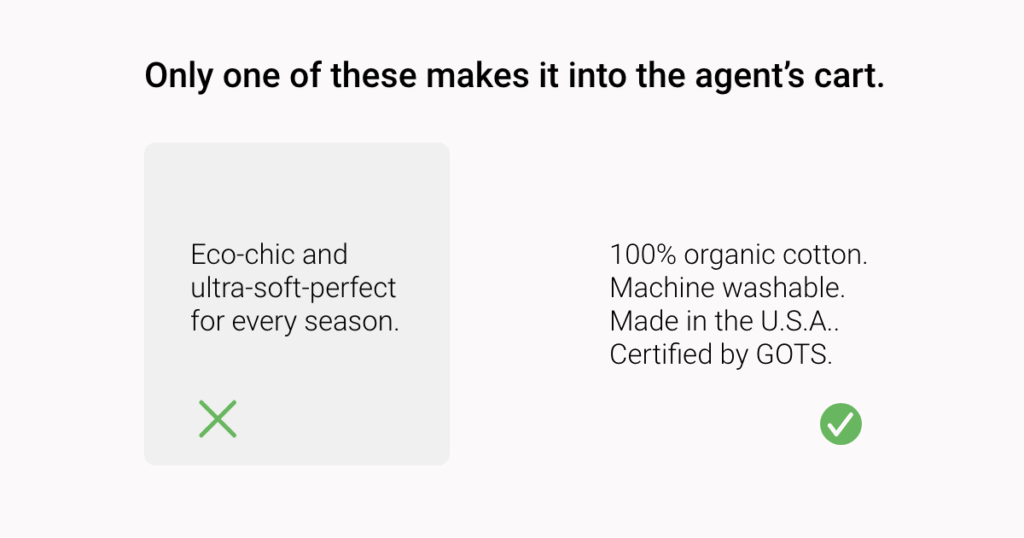

2. Prompt-Optimized Content is the New Shelf Placement

In the age of agentic AI, product content isn’t just read; it’s parsed, matched, and selected by algorithms. That makes your PDP (Product Detail Page) less like a billboard and more like a data feed.

AI agents don’t interpret vague phrases like “eco-luxe feel” or “crafted with care.” They zero in on specifics: “Made with 100% organic cotton,” “Certified cruelty-free,” “Ships within 24 hours.” To win placement in an agent’s shortlist, your product copy must match the language of prompts: structured, specific, and machine-readable.

Google’s Shopping Graph—which powers product results across Search, Lens, and Bard—pulls in over 35 billion listings from websites, reviews, videos, and product data feeds. It relies heavily on structured data to help users (and increasingly, AI systems) surface the most relevant items based on attributes, not just popularity or branding. Products without clear, structured metadata are far less likely to appear in filtered, prompt-based results.

In Walmart’s case, the new AI assistant is trained on its full product catalog and leverages Walmart’s own LLMs, which have been fine-tuned to understand product hierarchies, ingredient lists, sizing details, and dietary attributes, all of which come from structured product content.

Retailer Implication:

In this environment, clarity is currency. Your product won’t rank because it’s aspirational. It will rank because it fits the brief. Treat metadata and product copy like critical infrastructure. The smartest retail software solutions are already built to align with prompt-based discovery. Yours should be too.

3. Real-Time Pricing Becomes Table Stakes

AI shopping agents don’t wait for deals, click coupons, or browse the clearance section. They compare in milliseconds, scanning prices across multiple platforms, factoring in shipping fees, delivery timelines, and discounts, and then they buy. It’s commerce at machine speed.

For consumer brands, this is no longer just about staying competitive. It’s about staying visible. If your product’s price isn’t dynamically adjusted to compete in real-time, it might not make the agent’s shortlist at all.

Amazon is the benchmark here. Its algorithms reportedly update prices every 10 minutes across millions of listings, accounting for competitor changes, stock levels, and buyer behavior. This dynamic pricing model has made it a dominant force in algorithmic commerce.

Retailer Implication:

This is your moment of reckoning. Without a pricing engine that reacts in real-time across platforms, locations, and supply conditions, you’re playing catch-up in a game that’s already been automated. Pricing is no longer a decision. It’s a reflex.

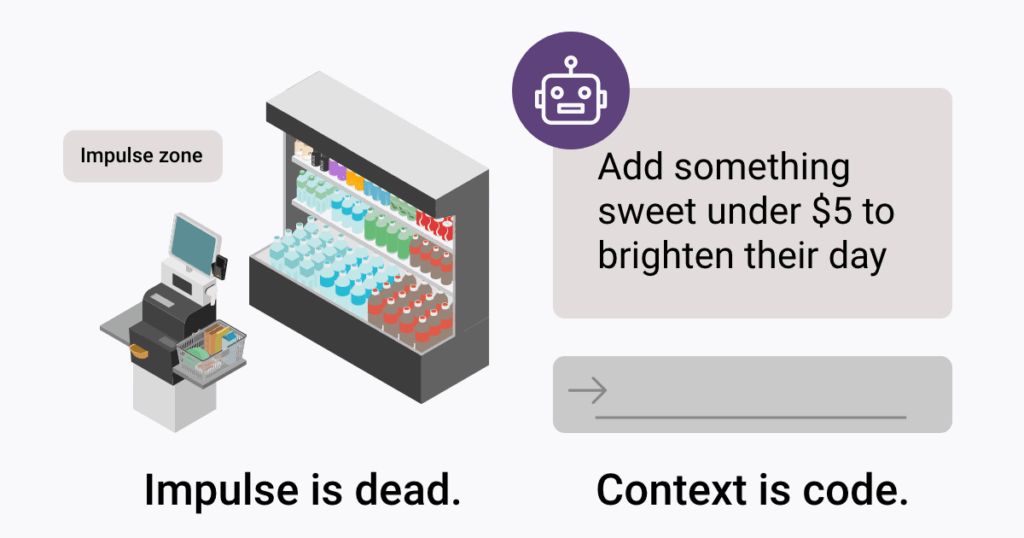

4. Emotional Triggers Don’t Work—Unless You Train Them In

AI agents don’t get tempted by end caps or swayed by seasonal packaging. They don’t “feel like” a treat. They don’t impulse buy.

That’s a major revenue gap for retailers. According to Capital One Shopping, impulse purchases account for up to 62% of grocery sales, and even higher in specific product categories. Invesp reports that 84% of all shoppers admit to making impulse buys, often triggered by placement, packaging, or promotions.

But AI agents aren’t wired for spontaneity. They execute logic, not emotion. They won’t grab that lip balm at checkout just because it’s “on sale today only.”

Walmart’s new AI assistant, for example, responds to intent-rich prompts like “help me prep for a family picnic,” auto-generating carts based on dietary filters, delivery constraints, and inventory—not sudden cravings. Similarly, Visa has introduced “Intelligent Commerce,” a suite of APIs that allows AI agents to shop and make purchases on behalf of consumers, based on their pre-selected preferences and spending limits. This initiative aims to streamline the shopping experience by enabling AI to handle tasks from product discovery to payment, all within user-defined parameters.

Retailer Implication:

If impulse buying is disappearing, emotional logic needs to be intentionally designed. That means integrating contextual cues like “add something refreshing” or “round off the gift” directly into prompt structures. AI agents can’t feel, but they can be programmed to act on emotional stand-ins through automation and AI logic that simulates shopper intent.

This isn’t the death of emotion in shopping; it’s the reinvention of it through code.

5. Viral Demand Is Now Instant and Machine-Led

When a product goes viral today, it’s not just people rushing to buy. It’s thousands of AI agents executing simultaneously.

A single TikTok video or influencer drop can trigger instantaneous, large-scale demand, not from viewers scrambling to click links, but from autonomous agents instructed to “buy what she just recommended” or “order what’s trending for spring skincare.” The traditional “drop day” playbook doesn’t apply when software does the shopping.

TikTok Shop has already shown that virality converts directly to sales at scale, with some products selling out in hours after trending clips. Brands like CeraVe, L’Oréal, Stanley, and Trader Joe’s have seen sudden surges tied to viral creator content. In early 2024, Trader Joe’s $2.99 mini canvas tote bags went viral on TikTok and sold out nationwide, with the products being resold for hundreds of dollars online on platforms like Facebook Marketplace and eBay.

AI agents thrive in digital platforms that enable real-time fulfillment, viral signal detection, and dynamic cart-building, where latency can cost visibility. These agents simply compress that cycle from hours to seconds, automating what used to be a human scramble into a seamless inventory sweep.

Retailer Implication:

The shelf-life of a trend is now measured in minutes. If your inventory, pricing, and fulfillment stack isn’t agent-ready, you’ll miss the window. Think less about being ready for demand and more about training your systems to detect and act on it before it peaks. That’s the first step toward an agentic AI retail strategy.

6. Discovery Will Depend on Interoperability, Not Branding

AI agents don’t care about your story. They care about your schema.

As shopping becomes increasingly autonomous, agents will choose products not based on branding, identity, or lifestyle alignment but on data accessibility and technical compatibility. The brands that win will be the ones whose systems can talk to AI agents fluently.

That means exposing structured product data, fulfillment timelines, delivery estimates, certifications, availability, and pricing in formats that agents can parse, query, and act on.

Amazon’s Product Advertising API gives developers access to structured data across its catalog—prices, availability, reviews, and more—so third-party apps and AI agents can retrieve and recommend products accurately. If your product data isn’t structured and accessible, you’re not even in the running.

Retailer Implication:

We’re in the AI agents era, and the new question isn’t “How compelling is your brand?” It’s “How agent-readable is your stack?” You’re not just selling to people anymore. You’re syncing with systems, and AI business solutions are becoming the connective tissue. If your product catalog isn’t API-enabled, searchable, or prompt-ready, you’re effectively invisible in an age increasingly driven by intelligent automation.

This is where the phrase “your product has to win the algorithm first” becomes operational reality.

The Future Is Prompted. And It’s Just Getting Started.

If AI agents are now your customer, your digital shelf needs to speak their language. From real-time pricing and metadata clarity to emotional logic and inventory sync, the rules of retail are being rewritten, not in boardrooms but in backends.

Walmart didn’t just roll out a new feature; it entered the chat in the most definitive way possible. The message? Shopping is no longer driven by personas, funnels, or splashy campaigns. It’s driven by prompts, precision, and system-to-system compatibility.

But this is just the opening act.

What comes next is bigger than any one assistant. As we move from AI agents to agentic AI, we’re talking about systems that don’t just respond; they reason. Agents that anticipate restocks. Reroute logistics. Optimize assortments.

It’s a shift that belongs on every digital transformation roadmap, not just the innovation team’s wishlist.

This isn’t a pivot. It’s the main character energy moment for brands that are ready to play in an algorithm-first world.

You don’t need to predict the future.

You just need to make sure your product is ready when it shows up.

Platforms like FD Ryze are already helping retailers do just that: build the intelligence layer behind smarter, more autonomous digital commerce solutions, bridging the gap between AI for business and retail execution.